SkyWest Airlines 2014 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(19) All other compensation for Mr. Kraupp for 2013 consists of: $43,599 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2013; $5,195 in employer-paid health insurance premiums;

$4,362 for personal use of the Company’s recreational equipment; and $1,599 in discretionary matching contributions under

the SkyWest 401(k) Plan.

(20) All other compensation for Mr. Kraupp for 2012 consists of: $41,273 of employer credits under the SkyWest Deferred

Compensation Plan attributable to compensation earned for 2012; $5,103 in employer-paid health insurance premiums;

$5,309 for personal use of the Company’s recreational equipment; and $1,108 in discretionary matching contributions under

the SkyWest 401(k) Plan.

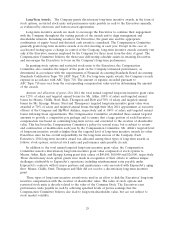

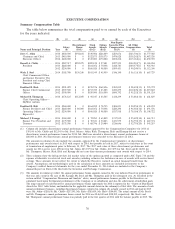

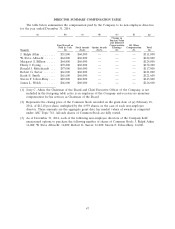

Grants of Plan-Based Awards For 2014

The following table provides information about non-equity based and equity-based plan awards

granted to the Executives for the year ended December 31, 2014:

(a) (b) (c) (d) (e) (f) (g) (h)

Estimated Estimated

Possible Possible All Other

Payouts Payouts All Other Option

Under Under Stock Awards:

Non-Equity Equity Awards: Number of Exercise

Incentive Incentive Number of Securities Price of

Plan Awards Plan Awards Shares Underlying Options Grant Date

Target Target of Stock Options Awards Full Fair

Name Grant Date ($) (# shares) (# shares) (# shares) ($S/share)(1) Value(2)

Jerry C. Atkin ....... 18-Feb-2014(3)(4) $809,078 — 27,354 50,570 $12.10 $557,035

Russell A. Childs ..... 18-Feb-2014 & $532,573 — 17,504 22,741 $12.10/$11.36 $306,609

15-May-2014(3)(4)

Wade J Steel ........ 18-Feb-2014 & $301,652 — 8,843 11,488 $12.10/$11.36 $149,508

15-May-2014(3)(4)

Bradford R. Rich ..... 18-Feb-2014(3)(4) $516,880 — 16,411 36,353 $12.10 $361,072

Michael B. Thompson . . 18-Feb-2014 & $286,474 — 8,404 10,919 $12.10/$11.36 $141,932

15-May-2014(3)(4)

Bradford R. Holt ..... 18-Feb-2014(3)(4) $442,680 — 13,558 17,614 $12.10 $242,787

Michael J. Kraupp .... 18-Feb-2014(3)(4) $213,904 — 5,974 14,275 $12.10 $136,094

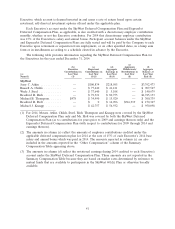

(1) The exercise price of the options of $12.10 per share for the February 18, 2014 grant date and $11.36 per share for

the May 15, 2014 grant date is the market closing price of the Common Stock on the date of grant.

(2) Column (h) shows the full grant date fair market value of the options granted in 2014 as computed under ASC

Topic 718 and the expense attributable to restricted stock unit awards granted in 2014 (excluding the effect of

estimates for forfeitures). Assumptions and methodologies used in the calculation of these amounts are included in

footnotes to the Company’s audited financial statements for the year ended December 31, 2014, which are included

in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission.

(3) On February 18, 2014 and May 15, 2014, the Company granted stock options, restricted stock units and performance

unit awards payable in cash pursuant to the 2010 Plan and approved the target annual performance bonuses for

2014. Each Executive’s target level of performance units granted in 2014, earned in 2014 and payable in 2017, and

target annual performance bonus earned in 2014, are included in the amount shown in column (c). Column (c) does

not include or reflect the additional discretionary performance units awarded to certain Executives in February 2015

based on 2014 service that are described in footnote (1) to the Summary Compensation Table above. The number of

shares underlying each Executive’s stock option grant earned in 2014, which vest and become exercisable in 2017, is

listed in column (f). The number of shares of Common Stock underlying each restricted stock unit award earned for

year 2014 and payable in 2017 is shown in column (e). All of the long-term incentive awards included in

columns (c) through (f), with the exception of the target annual performance bonus included in column (c), vest on

the third anniversary of the date of grant (with earlier acceleration upon a change in control of the Company).

(4) Based on the attained level of 2014 adjusted combined SkyWest Airlines and ExpressJet pretax earnings, excluding

the discretionary non-performance-target-based performance unit awards approved by the Compensation Committee

in 2015, each Executive earned 0.00% of his performance units awarded in 2014. Certain Executives, however,

received a discretionary grant of additional performance units in 2015 in recognition of their 2014 service. Those

additional discretionary performance unit grants are not reflected in this table but are included in the amounts

shown for 2014 in column (d), captioned ‘‘Discretionary Bonus,’’ of the Summary Compensation Table above.

Additionally, as a result of 2014 actual performance, the amounts of annual performance bonus, excluding

discretionary bonuses approved by the Compensation Committee, earned in 2014 were: Mr. Atkin—$283,676;

Mr. Childs—$237,593; Mr. Steel—$146,140; Mr. Rich—$185,039; Mr. Thompson—$138,239; Mr. Holt—$104,091;

and Mr. Kraupp—$87,812.

38