SkyWest Airlines 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

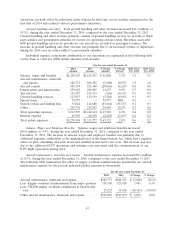

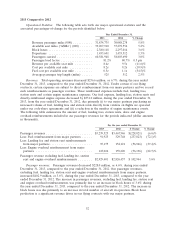

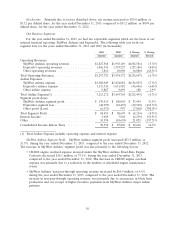

Summary of other income (expense) items and provision for income taxes:

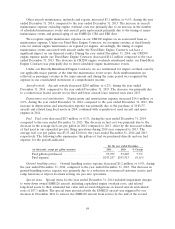

Other Income (expense), net. Other income (expense) for the 2014 year includes a gain of

$24.9 million resulting from the sale of our ownership in TRIP stock, offset by losses from the sale of

assets during 2014. Other income (expense) for the year ended December 31, 2014 primarily consisted

of $10.1 million associated with our sale of stock in Mekong Aviation Joint Stock Company, an airline

operating in Vietnam (‘‘Air Mekong’’), and recognition of maintenance deposit we collected associated

with the aircraft sub-leases we terminated with Air Mekong.

Provision for income taxes. The income tax provision for the 2014 year included a valuation

allowance of $6.0 million for previously generated state net operating loss benefits specific to

ExpressJet that we anticipate to expire, $2.0 million of foreign income tax associated with our sale of

ownership in TRIP stock, and the write-off of $2.4 million of tax assets associated with the sale of our

paint facility located in Saltillo, Mexico during 2014. These discrete income tax provision items were

partially offset by the income tax benefit associated with our loss before income tax of $16.3 million for

2014.

Net Income (loss). Primarily due to factors described above, we generated a net loss of

$24.2 million, or $(0.47) per diluted share, for the year ended December 31, 2014, compared to net

income of $59.0 million, or $1.12 per diluted share, for the year ended December 31, 2013.

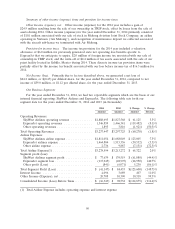

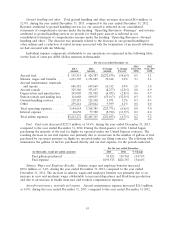

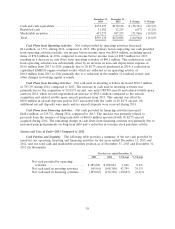

Our Business Segments:

For the year ended December 31, 2014, we had two reportable segments which are the basis of our

internal financial reporting: SkyWest Airlines and ExpressJet. The following table sets forth our

segment data for the years ended December 31, 2014 and 2013 (in thousands):

2014 2013 $ Change % Change

Amount Amount Amount Percent

Operating Revenues:

SkyWest Airlines operating revenue ............ $1,888,693 $1,827,568 $ 61,125 3.3%

ExpressJet operating revenues ................ 1,346,859 1,466,341 (119,482) (8.1)%

Other operating revenues .................... 1,895 3,816 (1,921) (50.3)%

Total Operating Revenues ..................... $3,237,447 $3,297,725 $ (60,278) (1.8)%

Airline Expenses:

SkyWest Airlines airline expense ............... $1,811,054 $1,688,049 $ 123,005 7.3%

ExpressJet airlines expense ................... 1,464,804 1,515,336 (50,532) (3.3)%

Other airline expense ....................... 2,736 9,887 (7,151) (72.3)%

Total Airline Expense(1) ...................... $3,278,594 $3,213,272 $ 65,322 2.0%

Segment profit (loss):

SkyWest Airlines segment profit ............... $ 77,639 $ 139,519 $ (61,880) (44.4)%

ExpressJet segment loss ..................... (117,945) (48,995) (68,950) 140.7%

Other profit (Loss) ........................ (841) (6,071) 5,230 (86.1)%

Total Segment Profit (Loss) .................... $ (41,147) $ 84,453 $(125,600) (148.7)%

Interest Income ............................ 4,096 3,689 407 11.0%

Other Income (Expense), net ................... 20,708 10,390 10,318 99.3%

Consolidated Income (Loss) Before Taxes .......... $ (16,343) $ 98,532 $(114,875) (116.6)%

(1) Total Airline Expense includes operating expense and interest expense

50