SkyWest Airlines 2014 Annual Report Download - page 49

Download and view the complete annual report

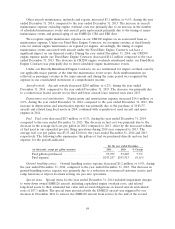

Please find page 49 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In November 2014, ExpressJet entered into an amended and restated ExpressJet United ERJ

Agreement, which reduced the term of the agreement from the year 2020 to 2017 and accelerated the

removal of ERJ145 aircraft from the contract between the years 2015 and 2017. As of December 31,

2014, all of ExpressJet’s ERJ145 aircraft were operated pursuant to the ExpressJet United ERJ

Agreement. The reduced term of the ExpressJet United ERJ Agreement shortened our anticipated use

of ERJ145 specific long-lived assets and resulted in an impairment review for such aircraft type specific

assets, which included capitalized aircraft improvements, spare engines and other ERJ145 long-lived

assets. The impairment analysis required us to use judgment to estimate the fair value of our ERJ145

long-lived assets. The amounts we ultimately realize from the disposal of our ERJ145 long-lived assets

may vary from our December 31, 2014 fair value assessments.

In conjunction with the acquisition of ExpressJet Delaware, we acquired an aircraft paint facility

located in Saltillo, Mexico. During the three months ended September 30, 2014, we discontinued use of

the facility and wrote down the value of the facility and related assets to its estimated fair value.

During the three months ended December 31 2014, we sold the paint facility to a third party for an

amount that approximated our estimated fair market value.

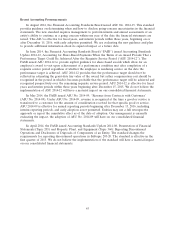

Stock-Based Compensation Expense

We estimate the fair value of stock options as of the grant date using the Black-Scholes option

pricing model. We use historical data to estimate option exercises and employee termination in the

option pricing model. The expected term of options granted is derived from the output of the option

pricing model and represents the period of time that options granted are expected to be outstanding.

The expected volatilities are based on the historical volatility of our common stock and other factors.

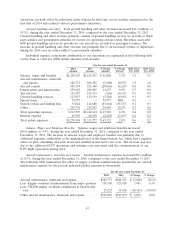

Fair value

We hold certain assets that are required to be measured at fair value in accordance with United

States GAAP. We determined fair value of these assets based on the following three levels of inputs:

Level 1—Quoted prices in active markets for identical assets or liabilities.

Level 2—Observable inputs other than Level 1 prices such as quoted prices for

similar assets or liabilities; quoted prices in markets that are not active; or

other inputs that are observable or can be corroborated by observable

market data for substantially the full term of the assets or liabilities. Some

of our marketable securities primarily utilize broker quotes in a non-active

market for valuation of these securities.

Level 3—Unobservable inputs that are supported by little or no market activity and

that are significant to the fair value of the assets or liabilities, therefore

requiring an entity to develop its own assumptions.

We utilize several valuation techniques in order to assess the fair value of our financial assets and

liabilities. Our cash and cash equivalents primarily utilize quoted prices in active markets for identical

assets or liabilities.

We have valued non-auction rate marketable securities using quoted prices in active markets for

identical assets or liabilities. If a quoted price is not available, we utilize broker quotes in a non-active

market for valuation of these securities. For auction-rate security instruments, quoted prices in active

markets are no longer available. As a result, we have estimated the fair values of these securities

utilizing a discounted cash flow model.

44