SkyWest Airlines 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

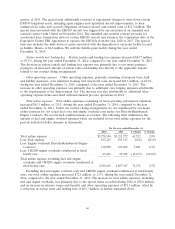

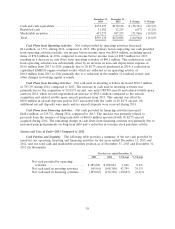

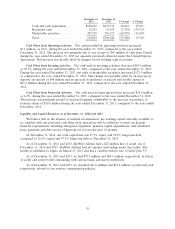

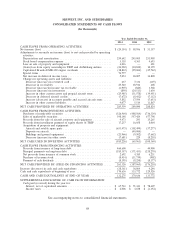

December 31, December 31,

2013 2012 $ Change % Change

Cash and cash equivalents ........ $170,636 $133,772 36,864 27.6%

Restricted cash ................ 12,219 19,553 (7,334) (37.5)%

Marketable securities ............ 487,239 556,117 (68,878) (12.4)%

Total ........................ 670,094 $709,442 (39,348) (5.5)%

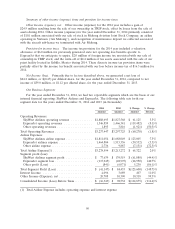

Cash Flows from Operating Activities. Net cash provided by operating activities increased

$1.1 million, or 0.4%, during the year ended December 31, 2013, compared to the year ended

December 31, 2012. The increase was primarily due to our receipt of $49 million of cash from United

during the year ended December 31, 2013 for amounts previously deferred under the United Express

Agreement. This increase was mostly offset by changes in our working capital accounts.

Cash Flows from Investing Activities. Net cash used in investing activities decreased $42.4 million,

or 39.1% during the year ended December 31, 2013, compared to the year ended December 31, 2012.

During the year ended December 31, 2013, net sales of marketable securities increased $127.4 million

as compared to the year ended December 31, 2012. This change was partially offset by an increase in

deposits on aircraft of $40 million and an increase in purchases of aircraft and rotable spares of

$45.2 million during the year ended December 31, 2013, compared to the year ended December 31,

2012.

Cash Flows from Financing Activities. Net cash used in financing activities increased $10.8 million,

or 6.2%, during the year ended December 31, 2013, compared to the year ended December 31, 2012.

The increase was primarily related to increased expense attributable to the increase in purchase of

treasury shares of $10.8 million during the year ended December 31, 2013, compared to the year ended

December, 2012.

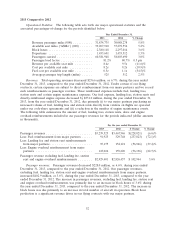

Liquidity and Capital Resources as of December 31, 2014 and 2013

We believe that in the absence of unusual circumstances, the working capital currently available to

us, together with our projected cash flows from operations, will be sufficient to meet our present

financial requirements, including anticipated expansion, planned capital expenditures, and scheduled

lease payments and debt service obligations for at least the next 12 months.

At December 31, 2014, our total capital mix was 47.7% equity and 52.3% long-term debt,

compared to 52.6% equity and 47.4% long-term debt at December 31, 2013.

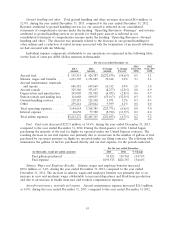

As of December 31, 2014 and 2013, SkyWest Airlines had a $25 million line of credit. As of

December 31, 2014 and 2013, SkyWest Airlines had no amount outstanding under the facility. The

facility is scheduled to expire on March 31, 2015 and has a variable interest rate of Libor plus 3%.

As of December 31, 2014 and 2013, we had $79.9 million and $88.5 million, respectively, in letters

of credit and surety bonds outstanding with various banks and surety institutions.

As of December 31, 2014 and 2013, we classified $11.6 million and $12.2 million as restricted cash,

respectively, related to our workers compensation policies.

59