SkyWest Airlines 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2014

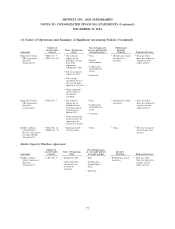

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

approach or report the cumulative effect as of the date of adoption. The Company is currently

evaluating the impact, the adoption of ASU No. 2014-09 will have on the Company’s consolidated

financial statements.

In April 2014, the FASB issued Accounting Standards Update 2014-08, Presentation of Financial

Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued

Operations and Disclosures of Disposals of Components of an Entity. The standard changes the

requirements for reporting discontinued operations in Subtopic 205-20. The standard is effective in the

first quarter of 2015. The Company does not believe the implementation of the standard will have a

material impact to the Company’s consolidated financial statements.

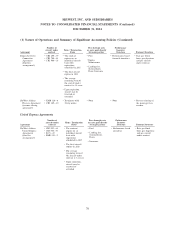

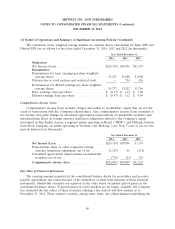

(2) Segment Reporting

Generally accepted accounting principles require disclosures related to components of a company

for which separate financial information is available to, and regularly evaluated by, the Company’s

CODM when deciding how to allocate resources and in assessing performance.

The Company’s two operating segments consist of the operations conducted by its two subsidiaries,

SkyWest Airlines and ExpressJet. Corporate overhead expense incurred by the Company is allocated to

the operating expenses of its two operating subsidiaries.

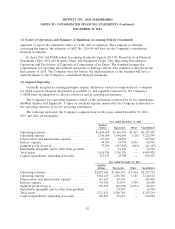

The following represents the Company’s segment data for the years ended December 31, 2014,

2013 and 2012 (in thousands).

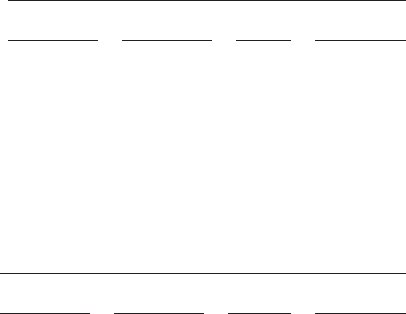

Year ended December 31, 2014

SkyWest

Airlines ExpressJet Other Consolidated

Operating revenues .......................... $1,888,693 $1,346,859 $1,895 $3,237,447

Operating expense ........................... 1,766,669 1,446,050 (120) 3,212,599

Depreciation and amortization expense ............ 171,183 88,459 — 259,642

Interest expense ............................. 44,385 18,754 2,856 65,995

Segment profit (loss)(1) ....................... 77,639 (117,945) (841) (41,147)

Identifiable intangible assets, other than goodwill ..... — 12,748 — 12,748

Total assets ................................ 3,019,799 1,390,129 — 4,409,928

Capital expenditures (including non-cash) .......... 673,133 23,790 — 696,923

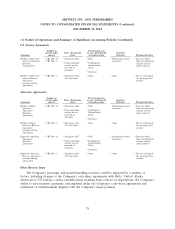

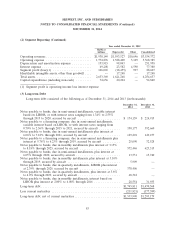

Year ended December 31, 2013

SkyWest

Airlines ExpressJet Other Consolidated

Operating revenues .......................... $1,827,568 $1,466,341 $ 3,816 $3,297,725

Operating expense .......................... 1,644,129 1,494,302 6,183 3,144,614

Depreciation and amortization expense ........... 155,667 89,338 — 245,005

Interest expense ............................ 43,920 21,034 3,704 68,658

Segment profit (loss)(1) ....................... 139,519 (48,995) (6,071) 84,453

Identifiable intangible assets, other than goodwill .... — 14,998 — 14,998

Total assets ................................ 2,532,431 1,700,788 — 4,233,219

Capital expenditures (including non-cash) .......... 103,387 38,657 — 142,044

82