SkyWest Airlines 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2014

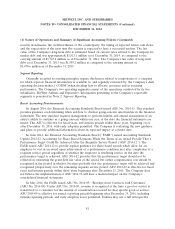

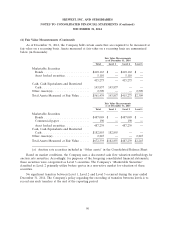

(6) Fair Value Measurements (Continued)

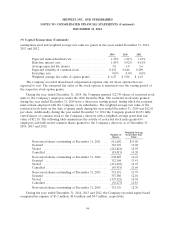

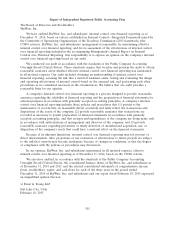

The following table presents the Company’s assets measured at fair value on a recurring basis

using significant unobservable inputs (Level 3) at December 31, 2014 (in thousands):

Fair Value Measurements Using Significant Unobservable Inputs

(Level 3)

Auction Rate

Securities

Balance at January 1, 2014 ................................. $2,245

Total realized and unrealized gains or (losses)

Included in earnings .................................... —

Included in other comprehensive income ..................... 64

Transferred out .......................................... —

Settlements ............................................. —

Balance at December 31, 2014 ............................... $2,309

(7) Investment in Other Companies

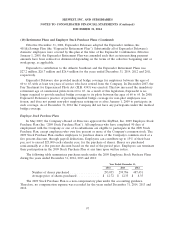

In 2012, the Company sold its 20% interest in TRIP to Trip Investimentos Ltda. (‘‘Trip

Investimentos’’) for $42 million. The purchase price was scheduled to be paid in three installments over

a two-year period and the Company received the final payment in July 2014. Under the terms of the

agreement, Trip Investimentos could not transfer the TRIP shares until the final installment payment

was made to the Company, which prevented the Company from recognizing the gain on the transaction

until the Company received the final payment. Accordingly, the Company recorded the gain from the

sale of its TRIP shares of $24.9 million during the year ended December 31, 2014, which is reflected in

‘‘Other Income’’ in the Consolidated Statements of Comprehensive Income (Loss).

As part of the sale transaction, the Company also received an option to acquire 15.38% of the

ownership in Trip Investimentos. The option has an initial exercise price per share equal to the price

paid by Trip Investimentos to acquire the TRIP shares from the Company. The exercise price escalates

annually at a specified rate and the Company can exercise the option, at its discretion, between the

second and fourth anniversaries of July 2014. The Company recorded the fair value of the option as

additional consideration received in the transaction. The value of the option was recorded at a nominal

amount based on the Company’s assessment of the option’s fair value.

In 2010, the Company invested $7 million for a 30% ownership interest in Mekong Aviation Joint

Stock Company, an airline operating in Vietnam (‘‘Air Mekong’’) and, in 2011, invested an additional

$3 million. In 2013, the Company sold its shares of Air Mekong and recognized a gain of $5 million

during the year ended December 31, 2013, which is reflected in other income in the Consolidated

Statements of Comprehensive Income (Loss). Additionally, in 2013, the Company terminated its

sub-lease of certain aircraft to Air Mekong and recognized $5.1 million of other income during the year

ended December 31, 2013 primarily due to the recognition of collected and realized contingent rent

payments, net of the write-off of certain maintenance deposits.

91