SkyWest Airlines 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.flights, on- time performance and baggage handling performance. In addition, the major and

regional airline often enter into an arrangement pursuant to which the major airline bears the

risk of changes in the price of fuel and other such costs that are passed through to the major

airline partner. Regional airlines benefit from a fixed-fee arrangement because they are sheltered

from some of the elements that cause volatility in airline financial performance, including

variations in ticket prices, passenger loads and fuel prices. However, regional airlines in fixed-fee

arrangements do not benefit from positive trends in ticket prices (including ancillary revenue

programs), passenger loads or fuel prices because the major airlines absorb most of these costs

associated with the regional airline flight, and the margin between the fixed-fees for a flight and

the expected per-flight costs tends to be smaller than the margins associated with revenue-

sharing arrangements.

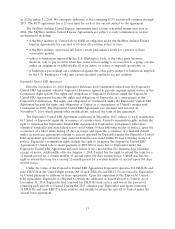

•Revenue-Sharing Arrangements. Under a revenue-sharing arrangement (referenced in this report

as a ‘‘revenue-sharing’’ arrangement or ‘‘pro-rate’’ arrangement), the major airline and regional

airline negotiate a passenger fare proration formula, pursuant to which the regional airline

receives a percentage of the ticket revenues for those passengers traveling for one portion of

their trip on the regional airline and the other portion of their trip on the major airline.

Substantially all costs associated with the regional airline flight are borne by the regional airline.

In such a revenue-sharing arrangement, the regional airline realizes increased profits as ticket

prices and passenger loads increase or fuel prices decrease and, correspondingly, the regional

airline realizes decreased profits as ticket prices and passenger loads decrease or fuel prices

increase.

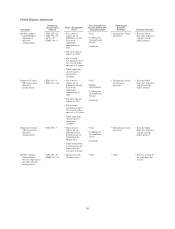

Code-Share Agreements

SkyWest Airlines has code-share agreements with United, Delta, American, US Airways and

Alaska. ExpressJet has code-share agreements with United, Delta and American.

These code-share agreements authorize Delta, United, American, Alaska and US Airways to

identify our flights and fares under their two-letter flight designator codes (‘‘DL,’’ ‘‘UA’’ ‘‘AA’’, ‘‘AS’’ or

‘‘US,’’ respectively) in the central reservation systems, and generally require us to paint our aircraft

with their colors and logos and to market our status as Delta Connection, United Express, American

Eagle, US Airways Express or Alaska, as applicable. Under each of our code-share agreements, our

passengers participate in the major partner’s frequent flyer program, and the major partner provides

additional services such as reservations, ticket issuance, ground support services and gate access. We

also coordinate our marketing, advertising and other promotional efforts with our major partners.

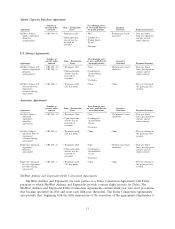

During the year ended December 31, 2014, approximately 88.2% of our passenger revenues related to

fixed-fee contract flights, where Delta, United, Alaska, American and US Airways controlled

scheduling, ticketing, pricing and seat inventories. The remainder of our passenger revenues during the

year ended December 31, 2014 related to pro-rate flights for Delta, United or American, where we

controlled scheduling, ticketing, pricing and seat inventories, and shared revenues with Delta, United or

American according to pro-rate formulas. The following summaries of our code-share agreements do

not purport to be complete and are qualified in their entirety by reference to the applicable agreement.

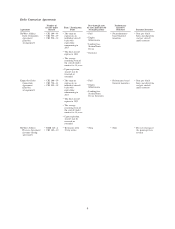

The number of aircraft under our fixed-fee arrangements and our pro-rate arrangements as of

December 31, 2014 is reflected in the summary below.

8