SkyWest Airlines 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2014

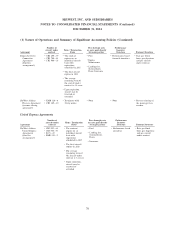

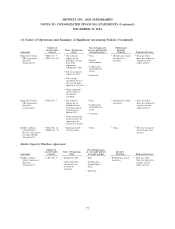

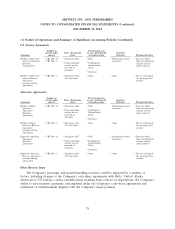

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

security investments, the creditworthiness of the counterparty, the timing of expected future cash flows,

and the expectation of the next time the security is expected to have a successful auction. The fair

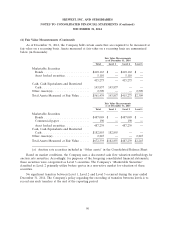

value of the Company’s long-term debt is estimated based on current rates offered to the Company for

similar debt and was approximately $1,813.1 million as of December 31, 2014, as compared to the

carrying amount of $1,745.8 million as of December 31, 2014. The Company’s fair value of long-term

debt as of December 31, 2013 was $1,509.2 million as compared to the carrying amount of

$1,470.6 million as of December 31, 2013.

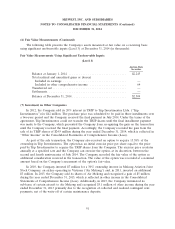

Segment Reporting

Generally accepted accounting principles require disclosures related to components of a company

for which separate financial information is available to, and regularly evaluated by, the Company’s chief

operating decision maker (‘‘CODM’’)when deciding how to allocate resources and in assessing

performance. The Company’s two operating segments consist of the operations conducted by its two

subsidiaries, SkyWest Airlines and ExpressJet. Information pertaining to the Company’s reportable

segments is presented in Note 2, Segment Reporting.

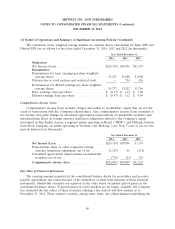

Recent Accounting Pronouncements

In August 2014, the Financial Accounting Standards Board issued ASU No. 2014-15. This standard

provides guidance on determining when and how to disclose going-concern uncertainties in the financial

statements. The new standard requires management to perform interim and annual assessments of an

entity’s ability to continue as a going concern within one year of the date the financial statements are

issued. This ASU is effective for fiscal years, and interim periods within those years, beginning on or

after December 15, 2016, with early adoption permitted. The Company is evaluating the new guidance

and plans to provide additional information about its expected impact at a future date.

In June 2014, the Financial Accounting Standards Board (‘‘FASB’’) issued Accounting Standards

Update 2014-12, Accounting for Share-Based Payments When the Terms of an Award Provide That a

Performance Target Could Be Achieved After the Requisite Service Period (‘‘ASU 2014-12’’). The

FASB issued ASU 2014-12 to provide explicit guidance for share-based awards which allow for an

employee to vest in an award upon achievement of a performance condition met after completion of a

requisite service period regardless of whether the employee is rendering service on the date the

performance target is achieved. ASU 2014-12 provides that the performance target should not be

reflected in estimating the grant-date fair value of the award, but rather compensation cost should be

recognized in the period in which it becomes probable that the performance target will be achieved and

recognized prospectively over the remaining requisite service period. ASU 2014-12 is effective for fiscal

years and interim periods within those years beginning after December 15, 2015. The Company does

not believe the implementation of ASU 2014-12 will have a material impact on the Company’s

consolidated financial statements.

In May 2014, the FASB issued ASU No. 2014-09, ‘‘Revenue from Contracts with Customers’’

(ASU No. 2014-09). Under ASU No. 2014-09, revenue is recognized at the time a good or service is

transferred to a customer for the amount of consideration received for that specific good or service.

ASU 2014-09 is effective for annual reporting periods beginning after December 15, 2016, including

interim reporting periods, and early adoption is not permitted. Entities may use a full retrospective

81