SkyWest Airlines 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

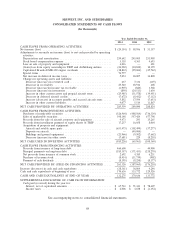

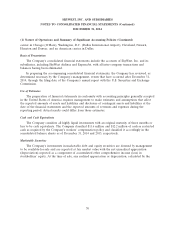

SKYWEST, INC. AND SUBSIDIARIES

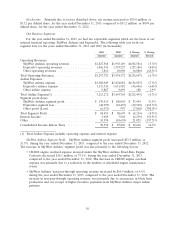

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In thousands, except per share amounts)

Year Ended December 31,

2014 2013 2012

OPERATING REVENUES:

Passenger ....................................... $3,168,000 $3,239,525 $3,467,546

Ground handling and other .......................... 69,447 58,200 66,826

Total operating revenues .......................... 3,237,447 3,297,725 3,534,372

OPERATING EXPENSES:

Salaries, wages and benefits ......................... 1,258,155 1,211,307 1,171,689

Aircraft maintenance, materials and repairs .............. 682,773 686,381 659,869

Aircraft rentals ................................... 305,334 325,360 333,637

Depreciation and amortization ....................... 259,642 245,005 251,958

Aircraft fuel ..................................... 193,247 193,513 426,387

Ground handling services ........................... 123,917 129,119 125,148

Special items .................................... 74,777 — —

Station rentals and landing fees ....................... 51,024 114,688 169,855

Other, net ...................................... 263,730 239,241 229,842

Total operating expenses .......................... 3,212,599 3,144,614 3,368,385

OPERATING INCOME ............................. 24,848 153,111 165,987

OTHER INCOME (EXPENSE):

Interest income .................................. 4,096 3,689 7,928

Interest expense .................................. (65,995) (68,658) (77,380)

Other, net ...................................... 20,708 10,390 (10,639)

Total other expense, net .......................... (41,191) (54,579) (80,091)

INCOME (LOSS) BEFORE INCOME TAXES ............ (16,343) 98,532 85,896

PROVISION FOR INCOME TAXES .................... 7,811 39,576 34,739

NET INCOME (LOSS) .............................. $ (24,154) $ 58,956 $ 51,157

BASIC EARNINGS (LOSS) PER SHARE ................ $ (0.47) $ 1.14 $ 1.00

DILUTED EARNINGS (LOSS) PER SHARE ............. $ (0.47) $ 1.12 $ 0.99

Weighted average common shares:

Basic .......................................... 51,237 51,688 51,090

Diluted ........................................ 51,237 52,422 51,746

COMPREHENSIVE INCOME (LOSS):

Net income (loss) ................................. $ (24,154) $ 58,956 $ 51,157

Proportionate share of other companies foreign currency

translation adjustment, net of taxes .................. (1,129) 66 (251)

Net unrealized appreciation (depreciation) on marketable

securities, net of taxes ............................ (719) (13) 316

TOTAL COMPREHENSIVE INCOME (LOSS) ............ $ (26,002) $ 59,009 $ 51,222

See accompanying notes to consolidated financial statements.

66