SkyWest Airlines 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

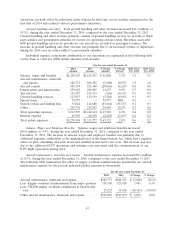

• SkyWest Airlines’ salaries, wages and employee benefits increased $20.3 million, or 3.7%, during

the year ended December 31, 2013, compared to the year ended December 31, 2012, primarily

due to increased block-hour production.

• SkyWest Airlines’ legal expense increased by $2.8 million. The increase in legal expense was

primarily related to the settlement of our dispute with Delta regarding non-revenue positive

space flying by employees of SkyWest Airlines and ExpressJet.

• SkyWest Airlines’ aircraft maintenance expense, excluding reimbursed engine overhauls,

increased by $26.7 million, or 12.5%, during the year ended December 31, 2013, compared to

the year ended December 31, 2012, which was primarily attributable to an increase in scheduled

maintenance events and the replacement and repair of aircraft parts and components.

• SkyWest Airlines’ ground handling service expense increased $9.3 million, or 12.6%, during the

year ended December 31, 2013, compared to the year ended December 31, 2012. The increase

in ground handling service expense was primarily due to SkyWest Airlines outsourcing the

customer service and ramp functions of several pro-rate stations.

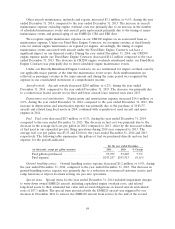

ExpressJet Segment Loss. ExpressJet segment loss increased $30.5 million, or 165.5%, during the

year ended December 31, 2013, compared to the year ended December 31, 2012. The increase in

ExpressJet segment loss was due primarily to the following factors:

• ExpressJet’s aircraft maintenance expense, excluding reimbursed engine overhauls, increased by

$45.7 million, or 20.6%, during the year ended December 31, 2013, compared to the year ended

December 31, 2012, which was primarily attributable to an increase in scheduled maintenance

events and the replacement and repair of aircraft parts and components.

• ExpressJet’s salaries, wages and employee benefits increased $19.4 million, or 3.1%, during the

year ended December 31, 2013, compared to the year ended December 31, 2012, primarily due

to increased block hour production.

• ExpressJet’s depreciation and amortization expense decreased $8.7 million, or 8.9%, during the

year ended December 31, 2013, compared to the year ended December 31, 2012, primarily due

to certain rotable assets being fully depreciated during the year ended 2013 and a lower volume

of capital expenditures.

• ExpressJet’s non-pass-through operating revenue increased by $25.3 million, or 2.4%, during the

year ended December 31, 2013, compared to the year ended December 31, 2012. The increase

in non-pass through operating revenue was primarily due to an increase in block hour

production, offset by a reduction in contract performance incentives.

Liquidity and Capital Resources

Sources and Uses of Cash—2014 Compared to 2013

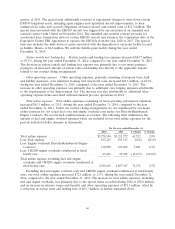

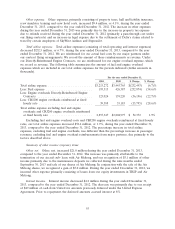

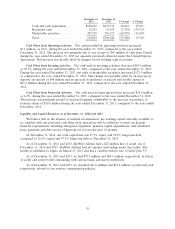

Cash Position and Liquidity. The following table provides a summary of the net cash provided by

(used in) our operating, investing and financing activities for the years ended December 31, 2014 and

2013, and our total cash and marketable securities position as of December 31, 2014 and December 31,

2013 (in thousands).

For the year ended December 31,

2014 2013 $ Change % Change

Net cash provided by operating activities ............ $285,539 $ 289,890 $ (4,351) (1.5)%

Net cash used in investing activities ............... (585,226) (65,961) (519,265) 787.2%

Net cash provided by (used in) financing activities ..... 261,326 (187,065) 448,391 (239.7)%

57