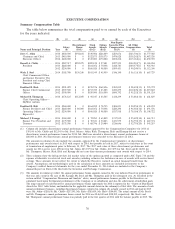

SkyWest Airlines 2014 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.order to receive the underlying shares. The compensation value of a restricted stock unit award does

not depend solely on future stock price increases; at grant, its value is equal to the market price of the

Common Stock. Although its value may increase or decrease with changes in the stock price during the

period before vesting, a restricted stock unit award will likely have value even without future stock

price appreciation. Accordingly, restricted stock unit awards deliver significantly greater share-for-share

compensation value at grant than do stock options, and the Company can offer what it anticipates will

be comparable grant date compensation value with approximately 65% fewer shares than if the grant

were made solely with stock options.

The annual award of restricted stock units to each Executive for 2014 consisted of the right to

receive upon future vesting a number of shares of Common Stock. The targeted restricted stock unit

allocation of each Executive’s aggregate, targeted level of long-term incentive compensation for 2014

was 35%.

Performance Units—The remaining component of each Executive’s 2014 annual long-term incentive

award was a performance unit award payable in cash under the 2010 Plan. The targeted cash allocation

of each Executive’s aggregate, targeted level of long-term incentive compensation for 2014 was 50%.

The purpose of the performance unit awards is to reward achievement of a financial efficiency goal

that supports shareholder value and reflects real performance without regard to stock market volatility.

Under each Executive’s performance unit award, a cash bonus is payable three years from the date of

grant, based on the level of pretax earnings actually attained for the year of grant, and subject to the

Executive’s continued employment through the date of payment. The 2014 committee-designated

combined targeted pretax earnings of SkyWest Airlines and ExpressJet was set as $110 million, with the

actual amount of cash bonus payable to each Executive to be adjusted in proportion to the extent to

which the combined SkyWest Airlines and ExpressJet actual results varied from the target level of

performance. Specifically, (i) if pretax earnings of SkyWest Airlines and ExpressJet had been equal to

or greater than $110 million, then 100% or more of the performance units would have been earned by

the Executive; (ii) if pretax earnings had ranged from $30 million to $110 million, then 50% to 100%

of the performance units would have been earned by the Executive; and (iii) if pretax earnings had

been less than $30 million, then no performance units would have been earned by the Executive.

The 2014 goal for each Executive was based on the combined SkyWest Airlines and ExpressJet

targeted pretax earnings, and there was no alternative operating company goal set for the Presidents of

the operating subsidiaries, thus encouraging teamwork and working towards the creation of long-term

value for the Company’s shareholders. In determining the degree to which the targeted pretax earnings

goal has been attained, pretax earnings are adjusted to exclude accounting timing differences between

engine overhauls, related revenue collected from contracts, other extraordinary items and other unusual

or non-recurring charges. Earned performance unit awards are paid in cash to reduce share dilution

and emphasize the real economic cost of officer incentives. The Company believes that the

performance unit grants provide an effective long-term incentive for the Executives to act in the best

interests of shareholders, by focusing on pretax earnings, which the Compensation Committee believes

is one of the principal contributing factors to long-term shareholder value.

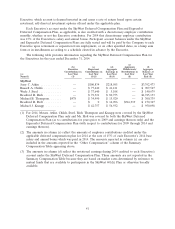

For 2014, the actual adjusted combined SkyWest Airlines and ExpressJet pretax loss was

$42.8 million. Because the actual adjusted combined SkyWest Airlines and ExpressJet pretax loss was

below the threshold pretax earnings of $30 million, none of the Executives received performance units

based upon the Company’s performance during 2014. In tabular form, the targeted pretax earnings,

31