SkyWest Airlines 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

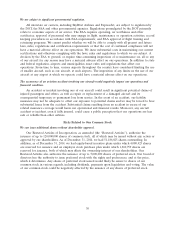

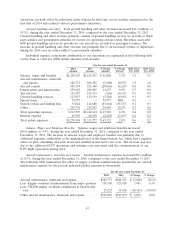

reporting periods. The table below summarizes how we are compensated by our major partners under

our flying contracts for engine expense and the method we use to recognize the corresponding expense.

Flying Contract Compensation of Engine Expense Expense Recognition

SkyWest Delta Connection ............. Directly-Reimbursed Engine Contracts Direct Expense Method

ExpressJet Delta Connection ........... Directly-Reimbursed Engine Contracts Direct Expense Method

SkyWest United Express (CRJ200) ....... Fixed-Rate Engine Contracts Direct Expense Method

SkyWest United Express (CRJ700) ....... Fixed-Rate Engine Contracts Power by the Hour Agreement

SkyWest United Express (E175) ......... Fixed-Rate Engine Contracts Power by the Hour Agreement

SkyWest United Express (EMB120) ....... Fixed-Rate Engine Contracts Deferral Method

ExpressJet United (CRJ200) ............ Fixed-Rate Engine Contracts Direct Expense Method

ExpressJet United (ERJ145) ............ Directly-Reimbursed Engine Contracts Power by the Hour Agreement

Alaska Agreement (CRJ700s) ........... Fixed-Rate Engine Contracts Power by the Hour Agreement

SkyWest American Agreement (CRJ200) . . . Fixed-Rate Engine Contracts Direct Expense Method

ExpressJet American Agreement (CRJ200) . . Fixed-Rate Engine Contracts Direct Expense Method

US Airways Agreement (CRJ200 / CRJ900) . Fixed-Rate Engine Contracts Direct Expense Method

Historically, multiple contractual relationships with major airlines have enabled us to reduce our

reliance on any single major airline code and to enhance and stabilize operating results through a mix

of fixed-fee flying arrangements and our pro-rate flying arrangements. For the year ended

December 31, 2014, contract flying revenue and pro-rate revenue represented approximately 88% and

12%, respectively, of our total passenger revenues. On contract routes, the major airline partner

controls scheduling, ticketing, pricing and seat inventories and we are compensated by the major airline

partner at contracted rates based on completed block hours, flight departures and other operating

measures.

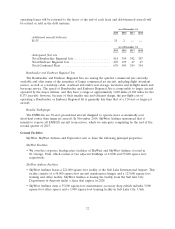

Financial Highlights

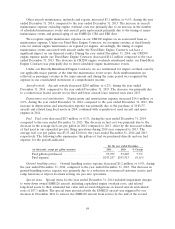

We had total operating revenues of $3.2 billion for the year ended December 31, 2014, a 1.8%

decrease, compared to total operating revenues of $3.3 billion for the year ended December 31, 2013.

We had a net loss of $24.2 million, or $(0.47) per diluted share, for the year ended December 31, 2014,

compared to $59.0 million, or $1.12 per diluted share, for the year ended December 31, 2013.

The significant items affecting our financial performance during the year ended December 31, 2014

are outlined below:

Revenue

Under our fixed-fee arrangements, certain expenses are subject to direct reimbursement from our

major partners and we record such reimbursements as passenger revenue (referred to as pass through

costs). These pass-through costs include fuel, landing fees, station rents and engine maintenance

expenses under certain fixed-fee contracts. Excluding the pass-through expenses for fuel, landing fees

and engine maintenance and the associated direct reimbursement from our major partners, our

passenger revenues increased from $2,570 million for the year ended December 31, 2013 to

$2,583 million for the year ended December 31, 2014, a $13 million increase. This increase during the

2014 year was primarily due to the addition of the E175 aircraft, certain contract renewals and

modifications at improved rates and increased volume of departures on routes subject to government

subsidies. Block hours incurred on completed flights is a significant driver of our revenue under our

fixed-fee arrangements. During the three months ended March 31, 2014, we experienced unusual

weather-related disruptions and cancelled approximately 15,800 more flights compared to the three

months ended March 31, 2013, or a 144% increase in weather-cancelled flights. The decrease in block

hour production from 2013 to 2014 was significantly concentrated in the ExpressJet ERJ145 aircraft

type, which has a lower revenue per block hour than our other flying contracts, as the aircraft lease

payments are paid directly by the major airline partner and we do not record revenue for expenses paid

directly to vendors by our major partners.

40