SkyWest Airlines 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The amount of dividends we pay may decrease or we may not pay dividends.

Historically, we have paid dividends in varying amounts on our common stock. The future payment

and amount of cash dividends will depend upon our financial condition and results of operations, loan

covenants and other factors deemed relevant by our board of directors. There can be no assurance that

we will continue our practice of paying dividends on our common stock or that we will have the

financial resources to pay such dividends.

The amount of common stock we repurchase may decrease from historical levels, or we may not repurchase

any additional shares of common stock.

Historically, we have repurchased shares of our common stock in varying amounts. Our future

repurchases of shares of common stock, if any, and the number of shares of common stock we may

repurchase will depend upon our financial condition, results of operations, loan covenants and other

factors deemed relevant by our Board of Directors. There can be no assurance that we will continue

our practice of repurchasing shares of common stock or that we will have the financial resources to

repurchase shares of common stock in the future.

Provisions of our charter documents and code-share agreements may limit the ability or desire of others to

gain control of our company.

Our ability to issue shares of preferred and common stock without shareholder approval may have

the effect of delaying or preventing a change in control and may adversely affect the voting and other

rights of the holders of our common stock, even in circumstances where such a change in control would

be viewed as desirable by most investors. The provisions of the Utah Control Shares Acquisitions Act

may also discourage the acquisition of a significant interest in or control of our company. Additionally,

our code-share agreements contain termination and extension trigger provisions related to change in

control type transactions that may have the effect of deterring a change in control of our company.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

ITEM 2. PROPERTIES

Flight Equipment

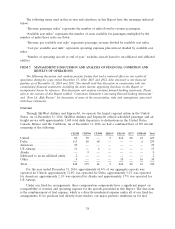

As of December 31, 2014, our fleet consisted of the following types of owned and leased aircraft:

Number of Number of Scheduled Average

Owned Leased Passenger Flight Cruising Average

Aircraft Type Aircraft Aircraft Capacity Range (miles) Speed (mph) Age (years)

CRJ200s ................. 94 154 50 1,500 530 12.9

CRJ700s ................. 70 69 70 1,600 530 9.6

CRJ900s ................. 11 53 90 1,500 530 7.1

E175s ................... 20 — 76 2,100 530 0.4

ERJ145s ................. — 226 50 1,500 530 12.7

ERJ135s ................. — 9 37 1,500 530 13.6

EMB120s ................ 18 25 30 300 300 17.3

The following table outlines the currently anticipated size and composition of our combined fleet

for the periods indicated. The projected fleet size schedule below assumes aircraft financed under

31