SkyWest Airlines 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Challenges

For 2014, ExpressJet reported a segment loss of $118 million (pre-tax), of which approximately

$88 million was attributed to the first half of 2014, when ExpressJet’s operations in Atlanta, Newark,

Dulles, Chicago and Houston experienced unprecedented severe weather and flight cancellations. In the

latter part of 2014, additional changes were made to help reduce operating losses, including several key

leadership changes, operational procedural changes and a reduced ERJ 145 contract length. Despite

these positive changes, several factors, such as managing through labor costs and attrition rates, aging

aircraft maintenance costs, removing an anticipated significant number aircraft from service, and the

impact of severe weather, may result in higher operating costs at ExpressJet and may limit our ability

to improve ExpressJet’s financial results. Driving improvement at ExpressJet through ongoing focus on

operational and financial performance remains a key objective in 2015.

For 2014, SkyWest Airlines reported a segment profit of $77 million (pre-tax). The 2014 results for

SkyWest Airlines include a special charge of $57 million associated with scheduled removal of the

EMB 120 Brasilia in 2015. While we anticipate the transition to an all-jet fleet will provide operating

efficiencies for SkyWest Airlines in the long-term, we may experience additional transition costs related

to pilot training and other EMB 120 wind-down activities in 2015. Successfully transitioning SkyWest

Airlines to an all-jet fleet is also a key objective in 2015.

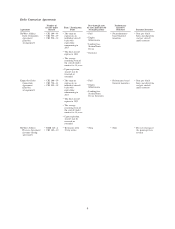

In 2015, various aircraft are scheduled for contract terminations under our fixed-fee flying

agreements with our major partners. Where possible, our goal is to renew and extend these terminating

contract arrangements at improved, current market rates. These scheduled contract terminations range

from mid-2015 through 2016, while our underlying financing commitment on the aircraft extends

beyond 2016. A clear challenge will be to extend terms or place these aircraft under a new code-share

agreement that will provide improved economic returns. In the event that we are unsuccessful in

extending such agreements or if we transition aircraft between code-share partners, we may experience

inefficiencies and lost revenue during a transition period. In 2015, we will be focused on improving

operating margins through improved renewal rates and reduced exposure to unprofitable aircraft.

With increased regulations surrounding pilot qualification and an increase in major airline hiring to

address mandatory retirements, one of our challenges for 2015 may be managing labor attrition rates

and attracting qualified new employees. Maintaining our position as the employer of choice for aviation

professionals will be a priority in 2015.

Liquidity

SkyWest generated over $285 million in cash from operating activities for each of the last three

consecutive years and ended 2014 with cash and marketable securities of approximately $560 million.

During 2014, we invested approximately $82 million as ownership toward the purchase of the E175s

and used $42 million to acquire spare aircraft parts to support the E175s. We currently anticipate

continuing our investment in the E175 aircraft and we believe our investment in the E175 operation

will generate positive financial returns for SkyWest and its shareholders.

SkyWest’s position in the industry and looking forward

SkyWest entities operate 73 percent of all United Express flying and 45 percent of Delta

Connection flying, as well as flying for American and Alaska Airlines. Together, SkyWest carriers

operate roughly 35 percent of all regional flying in the United States, with a fleet of approximately

750 aircraft. With every 13th passenger on a U.S. domestic flight flying on an aircraft operated by a

SkyWest entity, SkyWest plays a major role in the U.S. domestic airline system. However, our focus

going forward is not on size but to produce top operational performance and to increase pre-tax

income and return on invested capital. We expect to accomplish this by increasing total dual-class

aircraft and reducing total 50-seat aircraft in the fleet, maintaining focus on providing the best product,

and continuing to attract the industry’s best aviation professionals. We will likely be reducing the total

fleet count in the next three years to accomplish our goals. SkyWest believes the new leadership,