SkyWest Airlines 2014 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

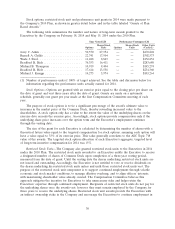

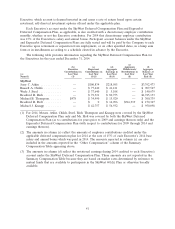

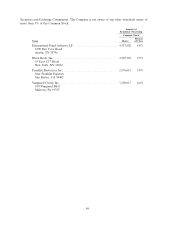

Option Awards Stock Awards

(b) (c) (g)

Number of Number of (f) Market

Securities Securities Number of Value of

Underlying Underlying (d) (e) Shares or Shares or

Unexercised Unexercised Option Option Share Units Share Units

(a) Options Options Exercise Expiration That Have That Have

Name Exercisable (#) Unexercisable (#) Price ($) Date(6) Not Vested (#) Not Vested(7)($)

Michael J. Kraupp . . . 36,000 — $17.11 1-Feb-15 — —

8,451 — $25.80 6-Feb-15 — —

15,531 — $15.24 4-Feb-16 — —

12,692 — $14.49 3-Feb-17 — —

12,185 — $15.51 2-Feb-18 — —

— 6,873(1) $13.06 15-Feb-19 5,268(1) $ 69,959

— 7,045(2) $13.24 13-Feb-20 5,326(2) $ 70,729

— 14,275(3) $12.10 18-Feb-21 5,974(3) $ 79,335

(1) Awards scheduled to vest on February 15, 2015.

(2) Awards scheduled to vest on February 13, 2016.

(3) Awards scheduled to vest on February 18, 2017.

(4) Awards scheduled to vest on May 15, 2017.

(5) By agreement approved by the Compensation Committee, all option awards held by Mr. Holt with option expiration dates

after April 1, 2017 were modified to have an option expiration date of April 1, 2017.

(6) Stock options awarded through 2005 expire ten years from date of grant. Stock options granted in 2006 and after expire

seven years from date of grant.

(7) Based on market closing price per share of Common Stock of $13.28 on December 31, 2014.

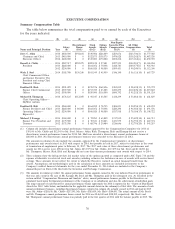

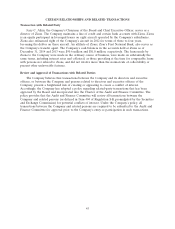

Option Exercises and Stock Vested

Stock options exercised and restricted stock units that vested for the Executives during the year

ended December 31, 2014 are outlined below.

Option Awards Stock Awards

(b) (c) (d) (e)

Number of Shares Value Realized Number of Shares Value Realized

(a) Acquired On Exercise on Exercise Acquired on Vesting on Vesting

Name (#)(1) ($) (#)(2) ($)

Jerry C. Atkin ................ — — 19,342 $251,639

Russell A. Childs .............. — — 9,826 $127,836

Wade J. Steel ................ — — 2,012 $ 26,176

Bradford R. Rich .............. — — 11,605 $150,981

Michael B. Thompson .......... — — 2,696 $ 35,074

Bradford R. Holt .............. — — 48,028 $410,149

Michael J. Kraupp ............. — — 4,020 $ 52,300

(1) No stock options were exercised by Executives during the year ended December 31, 2014.

(2) By separation agreement approved by the Compensation Committee, Mr. Holt’s outstanding

restricted stock units vested at his retirement.

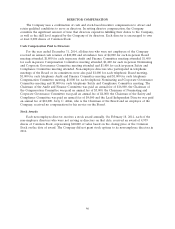

Non-Qualified Deferred Compensation for 2014

Pursuant to the SkyWest Deferred Compensation Plan and the ExpressJet Deferred Compensation

Plan, covered Executives may elect prior to the beginning of each calendar year to defer the receipt of

base salary and annual performance bonuses earned for the ensuing calendar year. Amounts deferred

are credited to an unfunded liability account maintained by the Company on behalf of the applicable

40