SkyWest Airlines 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

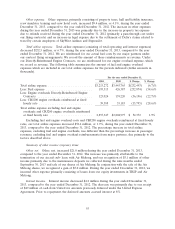

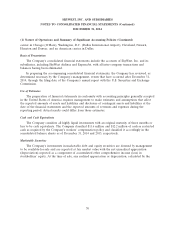

Significant Commitments and Obligations

General

The following table summarizes our commitments and obligations as noted for each of the next

five years and thereafter (in thousands):

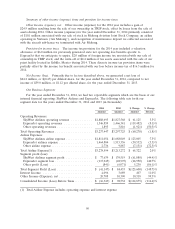

Total 2015 2016 2017 2018 2019 Thereafter

Operating lease payments for aircraft and

facility obligations .............. $1,536,321 $ 342,984 $269,210 $199,009 $153,338 $118,273 $ 453,507

Firm aircraft commitments .......... 572,498 562,526 9,972 — — — —

Interest commitments(A) ........... 395,677 69,978 62,218 54,273 46,875 40,084 122,249

Principal maturities on long-term debt . . . 1,745,811 211,821 216,340 190,648 168,769 161,329 796,904

Total commitments and obligations ..... $4,250,307 $1,187,309 $557,740 $443,930 $368,982 $319,686 $1,372,660

(A) At December 31, 2014, we had variable rate notes representing 41.3% of our total long-term debt. Actual interest

commitments will change based on the actual variable interest.

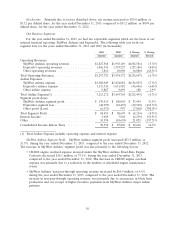

Purchase Commitments and Options

On May 21, 2013, we announced our execution of an agreement with Embraer, S.A. for the

purchase of 100 new E175 dual-class regional jet aircraft. Of the 100 aircraft, 47 are considered firm

deliveries and the remaining 53 aircraft are considered conditional deliveries until we enter into

capacity purchase agreements with other major airlines to operate the aircraft. As of December 31,

2014, we took delivery of 20 E175 aircraft and we anticipate taking delivery of the remaining 27 firm

delivery aircraft through the first quarter of 2016.

We have not historically funded a substantial portion of our aircraft acquisitions with working

capital. Rather, we have generally funded our aircraft acquisitions through a combination of operating

leases and long-term debt financing. At the time of each aircraft acquisition, we evaluate the financing

alternatives available to us, and select one or more of these methods to fund the acquisition. At

present, we intend to fund our acquisition of any additional aircraft through a combination of operating

leases and debt financing, consistent with our historical practices. Based on current market conditions

and discussions with prospective leasing organizations and financial institutions, we currently believe

that we will be able to obtain financing for our committed acquisitions, as well as additional aircraft,

without materially reducing the amount of working capital available for our operating activities.

Aircraft Lease and Facility Obligations

We also have significant long-term lease obligations, primarily relating to our aircraft fleet. At

December 31, 2014, we had 554 aircraft under lease with remaining terms ranging from one to

11 years. Future minimum lease payments due under all long-term operating leases were approximately

$1.5 billion at December 31, 2014. Assuming a 4.8% discount rate, which is the average rate used to

approximate the implicit rates within the applicable aircraft leases, the present value of these lease

obligations would have been equal to approximately $1.3 billion at December 31, 2014.

Long-term Debt Obligations

As of December 31, 2014, we had $1.7 billion of long-term debt obligations related to the

acquisition of CRJ200, CRJ700, CRJ900 and E175 aircraft. The average effective interest rate on those

long-term debt obligations was approximately 4.1% at December 31, 2014.

60