SkyWest Airlines 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2014

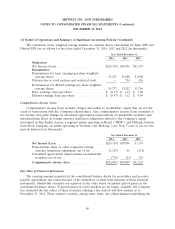

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

resulted in an impairment review of the Company’s long-lived assets specific to the EMB120 aircraft,

which included owned aircraft, capitalized engine overhaul amounts, spare engines and other EMB120

specific long-lived assets. The impairment analysis required the Company to use judgment to estimate

fair value of its EMB120 long-lived assets. The estimated fair value of the long-lived assets was based

on third-party valuations for similar assets. The amounts the Company may ultimately realize from the

disposal of the Company’s EMB120 long-lived assets may vary from the December 31, 2014 fair value

assessments. See Note 8, Special items, for the impairment charges recorded during the year ended

December 31, 2014 related to the EMB120 long-lived assets.

In November 2014, ExpressJet entered into an amended and restated ExpressJet United ERJ

Agreement, which reduced the term of the agreement from the year 2020 to 2017 and accelerated the

removal of its Embraer ERJ145 regional jet (‘‘ERJ145’’) aircraft from the contract between the years

2015 and 2017. As of December 31, 2014, all of ExpressJet’s ERJ145 aircraft were operated pursuant to

the ExpressJet United ERJ Agreement. The reduced term of the ExpressJet United ERJ Agreement

shortened the Company’s anticipated use of ERJ145 specific long-lived assets and resulted in an

impairment review for the ERJ145 aircraft type specific assets, which included capitalized aircraft

improvements, spare engines and other ERJ145 long-lived assets. The impairment analysis required the

Company to use judgment to estimate the fair value of the Company’s ERJ145 long-lived assets. The

estimated fair value of the long-lived assets was based on third-party valuations for similar assets. The

amounts the Company may ultimately realize from the disposal of the Company’s ERJ145 long-lived

assets may vary from the December 31, 2014 fair value assessments. See Note 8, Special items, for the

impairment charges recorded during the year ended December 31, 2014 related to the ERJ145

long-lived assets.

In conjunction with the acquisition of ExpressJet Delaware, the Company acquired an aircraft

paint facility located in Saltillo, Mexico. During the three months ended September 30, 2014, the

Company discontinued use of the facility and wrote down the value of the facility and related assets to

its estimated fair value. During the three months ended December 31, 2014, the Company sold the

paint facility to a third party for an amount that approximated the estimated fair market value. See

Note 8, Special items, for the impairment charges recorded during the year ended December 31, 2014

related to the write-down of the Saltillo, Mexico paint facility and related assets.

The Company did not impair its long-lived assets during 2013 or 2012.

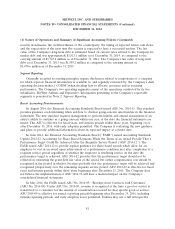

Capitalized Interest

Interest is capitalized on aircraft purchase deposits as a portion of the cost of the asset and is

depreciated over the estimated useful life of the asset. During the years ended December 31, 2014,

2013 and 2012, the Company capitalized interest costs of approximately $1.8 million, $1.2 million, and

$0, respectively.

Maintenance

The Company operates under a FAA-approved continuous inspection and maintenance program.

The Company uses the direct expense method of accounting for its regional jet engine overhauls

wherein the expense is recorded when the overhaul event occurs. The Company has engine services

73