SkyWest Airlines 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2014

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

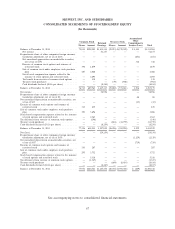

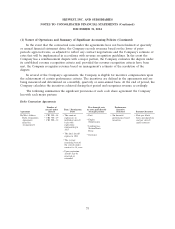

specific identification method, is recognized in other income and expense. The Company’s position in

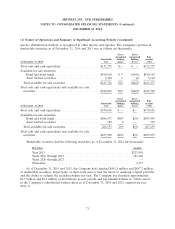

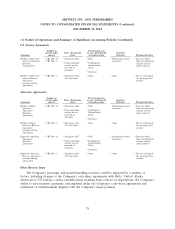

marketable securities as of December 31, 2014 and 2013 was as follows (in thousands):

Gross Gross

unrealized unrealized Fair

Amortized holding holding market

At December 31, 2014 Cost gains losses value

Total cash and cash equivalents .................... $132,275 $— $ — $132,275

Available-for-sale securities:

Bond and bond funds ........................ $410,618 $ 9 $(464) $410,163

Asset backed securities ....................... 5,108 3 (1) 5,110

Total available-for-sale securities .................. $415,726 $12 $(465) $415,273

Total cash and cash equivalents and available for sale

securities ................................... $548,001 $12 $(465) $547,548

Gross Gross

unrealized unrealized Fair

Amortized holding holding market

At December 31, 2013 Cost gains losses value

Total cash and cash equivalents .................... $170,636 $ — $— $170,636

Available-for-sale securities:

Bond and bond funds ........................ $486,571 $487 $(9) $487,049

Asset backed securities ....................... 182 8 — 190

Total available-for-sale securities .................. 486,753 495 $(9) 487,239

Total cash and cash equivalents and available for sale

securities ................................... $657,389 $495 $(9) $657,875

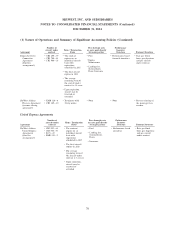

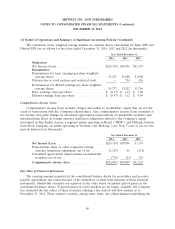

Marketable securities had the following maturities as of December 31, 2014 (in thousands):

Maturities Amount

Year 2015 ............................................... $233,858

Years 2016 through 2019 .................................... 181,406

Years 2020 through 2027 .................................... —

Thereafter ............................................... 2,317

As of December 31, 2014 and 2013, the Company had classified $415.3 million and $487.2 million

of marketable securities, respectively, as short-term since it had the intent to maintain a liquid portfolio

and the ability to redeem the securities within one year. The Company has classified approximately

$2.3 million and $2.2 million of investments as non-current and has identified them as ‘‘Other assets’’

in the Company’s consolidated balance sheet as of December 31, 2014 and 2013, respectively (see

Note 7).

71