SkyWest Airlines 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

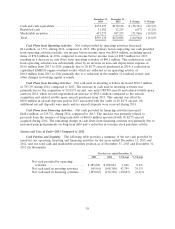

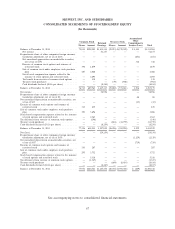

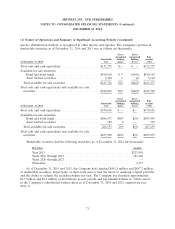

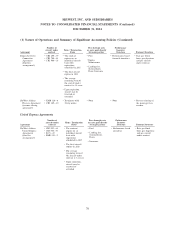

SKYWEST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands)

Accumulated

Other

Common Stock Treasury Stock

Retained Comprehensive

Shares Amount Earnings Shares Amount Income (Loss) Total

Balance at December 31, 2011 ................. 75,834 $598,985 $1,104,144 (25,221) $(370,309) $ 1,441 $1,334,261

Net income ........................... — — 51,157 — — — 51,157

Proportionate share of other companies foreign currency

translation adjustment, net of tax of $154 ......... — — — — — (251) (251)

Net unrealized appreciation on marketable securities,

net of tax of $194 ...................... — — — — — 316 316

Exercise of common stock options and issuance of

restricted stock ....................... 392 1,879 — — — — 1,879

Sale of common stock under employee stock purchase

plan .............................. 487 4,068 — — — — 4,068

Stock based compensation expense related to the

issuance of stock options and restricted stock ..... — 4,693 — — — — 4,693

Tax benefit from exercise of common stock options . . . — 138 — — — — 138

Treasury stock purchases ................... — — — (59) (902) — (902)

Cash dividends declared ($0.16 per share) ........ — — (8,184) — — — (8,184)

Balance at December 31, 2012 ................. 76,713 609,763 1,147,117 (25,280) (371,211) 1,506 1,387,175

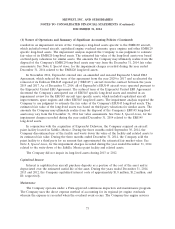

Net income ............................ — — 58,956 — — — 58,956

Proportionate share of other companies foreign currency

translation adjustment, net of tax of $8 .......... — — — — — 66 66

Net unrealized depreciation on marketable securities, net

of tax of $43 .......................... — — — — — (13) (13)

Exercise of common stock options and issuance of

restricted stock ......................... 313 835 — — — — 835

Sale of common stock under employee stock purchase

plan ................................ 300 3,696 — — — — 3,696

Stock based compensation expense related to the issuance

of stock options and restricted stock ............ — 4,363 — — — — 4,363

Tax deficiency from exercise of common stock options . . . — (146) — — — — (146)

Treasury stock purchases .................... — — — (816) (11,739) — (11,739)

Cash dividends declared ($0.16 per share) .......... — — (8,254) — — — (8,254)

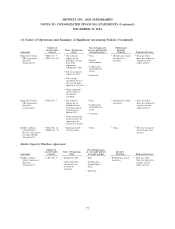

Balance at December 31, 2013 ................. 77,326 618,511 1,197,819 (26,096) (382,950) 1,559 1,434,939

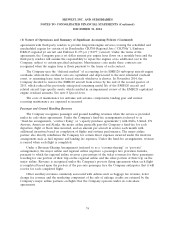

Net (loss) .............................. — — (24,154) — — — (24,154)

Proportionate share of other companies foreign currency

translation adjustment, net of tax of $678 ......... — — — — — (1,129) (1,129)

Net unrealized depreciation on marketable securities, net

of tax of $437 .......................... — — — — — (719) (719)

Exercise of common stock options and issuance of

restricted stock ......................... 330 287 — — — — 287

Sale of common stock under employee stock purchase

plan ................................ 295 3,752 — — — — 3,752

Stock based compensation expense related to the issuance

of stock options and restricted stock ............ — 5,318 — — — — 5,318

Tax deficiency from exercise of common stock options . . . — (1,347) — — — — (1,347)

Treasury stock purchases .................... — — — (669) (8,414) — (8,414)

Cash dividends declared ($0.16 per share) .......... — — (8,187) — — — (8,187)

Balance at December 31, 2014 ................. 77,951 $626,521 $1,165,478 (26,765) $(391,364) $ (289) $1,400,346

See accompanying notes to consolidated financial statements.

67