SkyWest Airlines 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2014

(11) Stock Repurchase

The Company’s Board of Directors has authorized the repurchase of up to 25,000,000 shares of

the Company’s common stock in the public market since 2007. Effective September 14, 2012, the

Company’s Board of Directors adopted the SkyWest, Inc. 2012 Stock Repurchase Plan (the ‘‘Stock

Repurchase Plan’’), which provided for the repurchase of up to 5,044,516 shares of common stock,

from time to time in open market or privately negotiated transactions, as contemplated by Rule 10b5-1

promulgated under the Exchange Act, as amended. The Stock Repurchase Plan expired on October 15,

2014. During the years ended December 31, 2014, 2013 and 2012, the Company repurchased

0.7 million, 0.8 million, 0.1 million shares of common stock for approximately $8.4 million,

$11.7 million and $0.9 million, respectively at a weighted average price per share of $12.54, $14.40 and

$15.32, respectively.

(12) Related-Party Transactions

The Company’s President, Chairman of the Board and Chief Executive Officer, serves on the

Board of Directors of Zions Bancorporation (‘‘Zions’’). The Company maintains a line of credit (see

Note 3) and certain bank accounts with Zions. Zions is an equity participant in leveraged leases on

two CRJ200, two CRJ700 and four EMB120 aircraft operated by the Company’s subsidiaries. Zions

also refinanced six CRJ200 and two CRJ700 aircraft in 2012 for terms of three to four years, becoming

the debtor on these aircraft. Zions also serves as the Company’s transfer agent. The Company’s cash

balance in the accounts held at Zions as of December 31, 2014 and 2013 was $90.6 million and

$81.8 million, respectively.

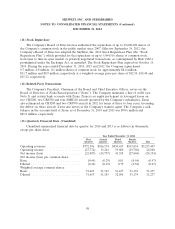

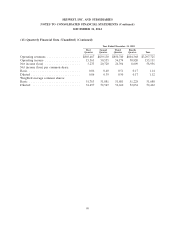

(13) Quarterly Financial Data (Unaudited)

Unaudited summarized financial data by quarter for 2014 and 2013 is as follows (in thousands,

except per share data):

Year Ended December 31, 2014

First Second Third Fourth

Quarter Quarter Quarter Quarter Year

Operating revenues ................... $772,386 $816,574 $834,633 $813,854 $3,237,447

Operating income .................... (27,774) 13,244 59,080 (19,702) 24,848

Net income (loss) .................... (22,887) (14,737) 41,338 (27,868) (24,154)

Net income (loss) per common share:

Basic .............................. (0.44) (0.29) 0.81 (0.54) (0.47)

Diluted ............................ (0.44) (0.29) 0.79 (0.54) (0.47)

Weighted average common shares:

Basic: ............................. 51,467 51,183 51,127 51,174 51,237

Diluted: ........................... 51,467 51,183 52,036 51,174 51,237

98