SkyWest Airlines 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2014

(4) Income Taxes (Continued)

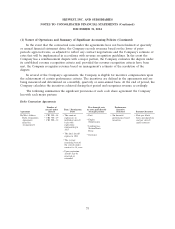

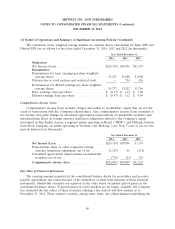

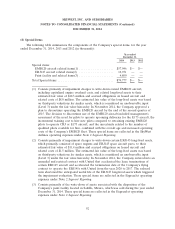

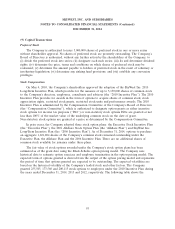

The following is a reconciliation between the statutory federal income tax rate of 35% and the

effective rate which is derived by dividing the provision for income taxes by income (loss) before for

income taxes (in thousands):

Year ended December 31,

2014 2013 2012

Computed provision (benefit) for income taxes at the statutory rate .... $(5,720) $34,486 $30,064

Increase (decrease) in income taxes resulting from:

State income tax provision (benefit), net of federal income tax benefit . (107) 2,867 2,220

Non-deductible expenses .................................. 3,865 3,257 2,919

Valuation allowance changes affecting the provision for income taxes . . 5,981 1,430 1,614

Foreign income taxes, net of federal & state benefit .............. 1,973 — —

Other, net ............................................. 1,819 (2,464) (2,078)

Provision for income taxes .................................. $7,811 $39,576 $34,739

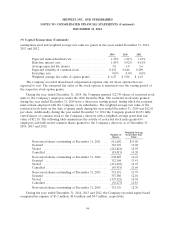

For the year ended December 31, 2014, the Company recorded a $6.0 million valuation allowance

against certain deferred tax assets primarily associated with ExpressJet state net operating losses with a

limited carry forward period. The valuation allowance was based on the Company’s assessment of

deferred tax assets that are anticipated to expire before the deferred tax assets may be utilized. The

Company additionally recorded a $2.0 million foreign tax expense associated with Brazilian withholding

tax on the sale of the Company’s equity ownership in TRIP. Included in Other, net above is an

unrecorded tax benefit of $3.4 million related to losses resulting from the disposition of a paint facility

in Mexico.

For the year ended December 31, 2013, the Company recorded a $1.4 million valuation allowance

against certain deferred tax assets primarily associated with ExpressJet state net operating losses with a

limited carry forward period. The valuation allowance was based on the Company’s assessment at

December 31, 2013 of deferred tax assets that were anticipated to expire before the deferred tax assets

may be utilized.

For the year ended December 31, 2012, the Company recorded a $1.6 million valuation allowance

against certain deferred tax assets associated with capital losses with a limited carry forward period.

The valuation allowance was based on the Company’s assessment at December 31, 2012 of deferred tax

assets that were anticipated to expire before the deferred tax assets may be utilized.

85