Sears 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

Our management, with the participation of our principal executive officer and principal financial officers,

conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and

procedures, as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), as of the end of the period covered by this report (the “Evaluation Date”). Based on this evaluation, the

principal executive officer and principal financial officers concluded that, as of the Evaluation Date, our

disclosure controls and procedures were effective in ensuring that information required to be disclosed by us in

the reports that we file or submit under the Exchange Act (i) is recorded, processed, summarized and reported

within the time periods specified in the SEC’s rules and forms and (ii) is accumulated and communicated to our

management, including our principal executive and principal financial officers, as appropriate to allow timely

decisions regarding required disclosure.

In addition, based on that evaluation, no changes in our internal control over financial reporting have

occurred during our last fiscal quarter that have materially affected, or are reasonably likely to materially affect,

our internal control over financial reporting.

See Management’s Annual Report on Internal Control over Financial Reporting and the Attestation Report

of the Registered Public Accounting Firm included in Item 8 of this Report, which reports are incorporated

herein by this reference.

Item 9B. Other Information

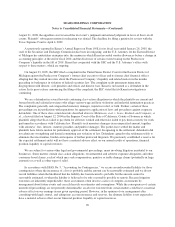

On March 12, 2009, the Compensation Committee of the Board of Directors of the Company approved an

amendment (the “Amendment”) to the 2007 Executive Long-Term Incentive Program (the “2007 LTIP”) to

convert the performance-based restricted stock awards (“Stock Awards”) granted under the 2007 LTIP to cash

incentive awards. Each cash incentive award consists of a number of units equal to the number of shares of

Company common stock covered by the original Stock Award. Each unit has a value equal, as of any date, to the

value of a share of the Company’s common stock on that date. Each cash incentive award constitutes a

commitment by the Company to distribute an amount equal to the number of units multiplied by the fair market

value of a share of the Company’s common stock at the time of distribution, subject to satisfaction of all of the

terms and conditions described in the 2007 LTIP as amended by the Amendment. Payment of the cash incentive

awards is subject to the same EBITDA performance goal, vesting requirements and other terms and conditions as

the original Stock Awards. Each cash incentive award is expected to be satisfied by a distribution in cash to the

participant, provided, however, that, at the discretion of the Compensation Committee, the Company may elect to

satisfy such cash incentive award by payment of shares of the Company’s common stock in lieu of cash, or a

combination of cash and shares of the Company’s common stock. For additional information regarding the 2007

LTIP, see the Company’s proxy statement dated March 26, 2008. The Company’s interim Chief Executive

Officer and President, W. Bruce Johnson, is the only named executive officer (as such term is defined in Item

5.02 of SEC Form 8-K) who held a Stock Award on March 12, 2009. Mr. Johnson surrendered 19,667 shares of

performance-based restricted stock to the Company in exchange for a cash incentive award consisting of 19,667

units.

On March 12, 2009, one of our current directors, Richard C. Perry, advised us that he has decided not to

stand for re-election to our Board of Directors at the Company’s Annual Meeting of Stockholders to be held on

May 4, 2009 in order to devote more time to Perry Capital matters. Mr. Perry has indicated his intention to serve

until the Annual Meeting.

97