Sears 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

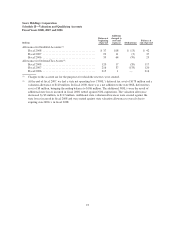

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

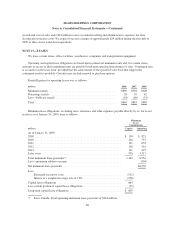

NOTE 13—GOODWILL AND INTANGIBLE ASSETS

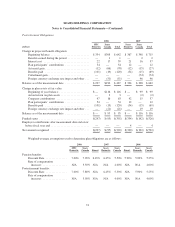

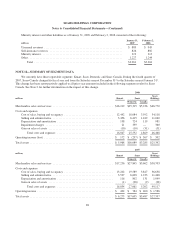

The following summarizes our intangible assets as of January 31, 2009 and February 2, 2008, respectively, the

amortization expenses recorded for the fiscal years then ended, as well as our estimated amortization expense for the next

five fiscal years and thereafter.

January 31, 2009 February 2, 2008

millions

Weighted

Average Life

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Amortized intangible assets

Favorable lease rights ............................. 21 $ 460 $164 $ 492 $147

Contractual arrangements and customer lists ........... 8 247 117 246 90

Trade names .................................... 8 75 29 62 21

782 310 800 258

Unamortized intangible assets

Trade names .................................... 2,811 — 2,811 —

Total .............................................. $3,593 $310 $3,611 $258

Aggregate Amortization Expense

Fiscal 2008 ................................................................ $ 84

Fiscal 2007 ................................................................ 90

Fiscal 2006 ................................................................ 87

Estimated Amortization

Fiscal 2009 ................................................................ $ 74

Fiscal 2010 ................................................................ 68

Fiscal 2011 ................................................................ 63

Fiscal 2012 ................................................................ 59

Fiscal 2013 ................................................................ 36

Thereafter ................................................................. 172

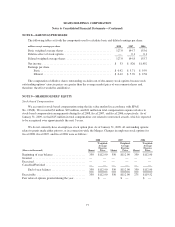

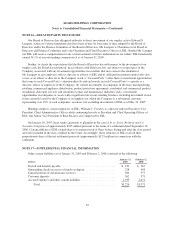

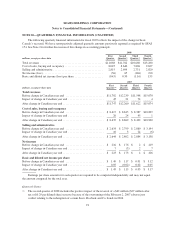

Goodwill is the excess of the purchase price over the fair value of the net assets acquired in business combinations

accounted for under the purchase method. We recorded $1.7 billion in goodwill in connection with the Merger. We recorded

$12 million in connection with our acquisition of an additional 3% interest in Sears Canada during fiscal 2008 and recorded

$167 million in connection with our acquisition of an additional 16% interest in Sears Canada during fiscal 2006.

Changes in the carrying amount of goodwill by segment during fiscal years 2007 and 2008 are as follows:

millions

Sears

Domestic

Sears

Canada Total

Balance, February 3, 2007 ........................................................ $1,434 $258 $1,692

Tax adjustments and other items affecting Merger-related goodwill ................... (6) — (6)

Balance, February 2, 2008 ........................................................ $1,428 $258 $1,686

Acquisition of additional interest in Sears Canada ................................. — 12 12

Impairment charges ......................................................... (262) — (262)

Tax adjustments affecting Merger-related goodwill ................................ (69) 25 (44)

Balance, January 31, 2009 ........................................................ $1,097 $295 $1,392

84