Sears 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

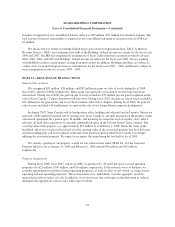

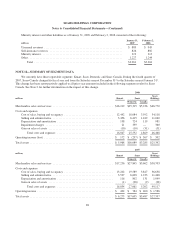

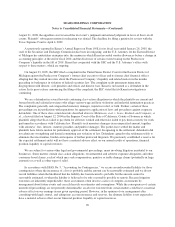

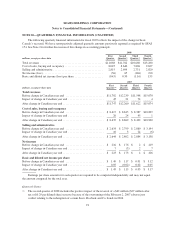

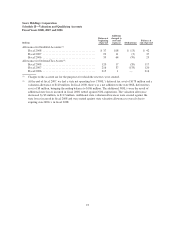

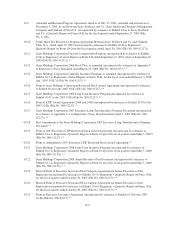

Notes to Consolidated Financial Statements—(Continued)

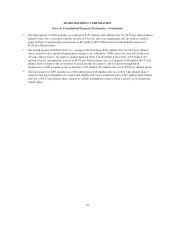

(2) The third quarter of 2008 includes (i) a charge of $101 million ($61 million after tax $0.49 per diluted share)

related to the costs associated with the closure of 14 stores and asset impairment and (ii) mark-to-market

gains on Sears Canada hedge transactions of $67 million ($29 million after tax and minority interest or

$0.23 per diluted share).

(3) The fourth quarter of 2008 includes (i) a charge of $336 million ($187 million after tax $1.53 per diluted

share) related to the a goodwill impairment charge at our subsidiary, OSH, and costs associated with store

closings and severance, (ii) mark-to-market gains on Sears Canada hedge transactions of $9 million ($4

million after tax and minority interest or $0.03 per diluted share), (iii) a tax benefit of $8 million ($0.07 per

diluted share) related to the resolution of certain income tax matters, and (iv) gains on negotiated

repurchases of debt securities prior to maturity of $9 million ($5 million after tax or $0.04 per diluted share).

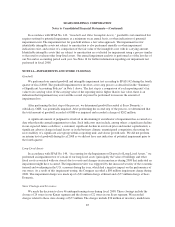

(4) The first quarter of 2007 includes (i) a $30 million gain ($18 million after tax or $0.12 per diluted share)

related to the legal settlement of a contractual dispute and (ii) a curtailment gain of $27 million ($16 million

after tax or $0.11 per diluted share) related to certain amendments made to Sears Canada’s post-retirement

benefit plans.

92