Sears 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

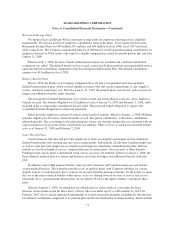

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

benefits for those Sears Canada associates who will not have achieved eligibility for such benefits by

December 31, 2008. The amendments to the post-retirement programs generated a curtailment gain and reduction

to the benefit plan obligation in the amount of $27 million during the fiscal year ended February 2, 2008.

Merger of Plans

The Kmart tax-qualified defined benefit pension plan was merged with and into the Sears domestic pension

plan effective as of the end of the day January 30, 2008. The merged plan was renamed as the Sears Holdings

Pension Plan (“SHC domestic plan”) and Holdings accepted sponsorship of the SHC domestic plan effective as

of that date.

Effective January 1, 2007, the Kmart pre-65 retiree medical plan and the Sears pre-65 and post-65 retiree

medical plans were merged into a master retiree medical program sponsored by Holdings. Effective

December 19, 2007, this master program was merged with a subsidiary’s retiree program, creating a new master

plan, which includes separate Holdings pre-65 and post-65 programs. Eligible Kmart associates who retired on or

after January 1, 2008 and all eligible Sears retirees are covered by both of these programs. Kmart associates who

retired before January 1, 2008 are eligible for the pre-65 program only.

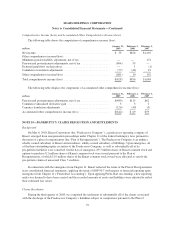

Changes in Accounting for Pensions and Postretirement Plans

Effective January 31, 2009, SFAS No. 158 required us to measure plan assets and benefit obligations at

fiscal year end. We previously performed this measurement at December 31 of each year. The change in our

measurement date did not have a material impact on our results of operations or financial condition.

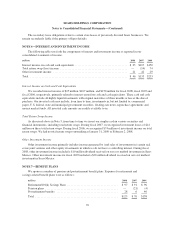

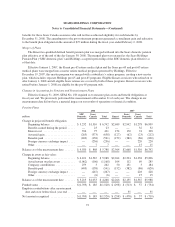

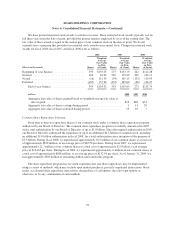

Pension Plans

2008 2007

millions

SHC

Domestic

Sears

Canada Total Kmart

Sears

Domestic

Sears

Canada Total

Change in projected benefit obligation

Beginning balance ................. $5,232 $1,510 $ 6,742 $2,689 $2,942 $1,278 $6,909

Benefits earned during the period ..... — 23 23 — — 32 32

Interest cost ...................... 356 75 431 154 170 74 398

Actuarial gain ..................... (265) (373) (638) (127) (62) (23) (212)

Benefits paid ..................... (403) (138) (541) (152) (382) (86) (620)

Foreign currency exchange impact .... — (236) (236) — — 220 220

Other ........................... — 7 7 — — 15 15

Balance as of the measurement date ....... $4,920 $ 868 $ 5,788 $2,564 $2,668 $1,510 $6,742

Change in assets at fair value:

Beginning balance ................. $4,421 $1,567 $ 5,988 $2,264 $2,294 $1,338 $5,896

Actual return on plan assets .......... (1,062) (106) (1,168) 104 112 69 285

Company contributions ............. 259 3 262 50 131 3 184

Benefits paid ..................... (403) (138) (541) (152) (382) (86) (620)

Foreign currency exchange impact .... — (267) (267) — — 228 228

Other ........................... — (6) (6) — — 15 15

Balance as of the measurement date ....... $3,215 $1,053 $ 4,268 $2,266 $2,155 $1,567 $5,988

Funded status ......................... $(1,705) $ 185 $(1,520) $ (298) $ (513) $ 57 $ (754)

Employer contributions after measurement

date and on or before fiscal year end ..... — — — — 35 — 35

Net amount recognized ................. $(1,705) $ 185 $(1,520) $ (298) $ (478) $ 57 $ (719)

72