Sears 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

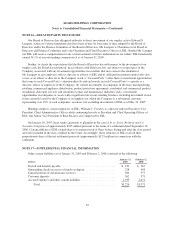

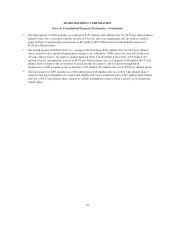

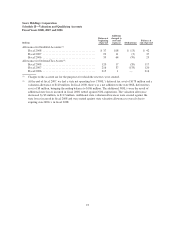

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

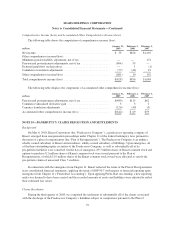

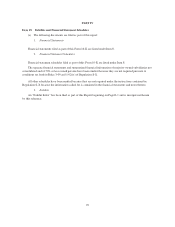

2006

millions Kmart Sears

Sears

Holdings

Domestic Canada

Merchandise sales and services ................................. $18,647 $29,179 $5,190 $53,016

Costs and expenses

Cost of sales, buying and occupancy ........................ 14,061 20,120 3,643 37,824

Selling and administrative ................................. 3,623 6,820 1,131 11,574

Depreciation and amortization ............................. 77 927 139 1,143

Gain on sales of assets .................................... (71) (11) — (82)

Restructuring charges .................................... 9 — 19 28

Total costs and expenses .............................. 17,699 27,856 4,932 50,487

Operating income ........................................... $ 948 $ 1,323 $ 258 $ 2,529

Total assets ................................................ $ 7,750 $19,209 $2,947 $29,906

NOTE 19—LEGAL PROCEEDINGS

Maurice Levie, individually and on behalf of all others similarly situated v. Sears, Roebuck & Co., et al.—

Following the announcement of the Merger on November 17, 2004, a lawsuit was filed in the United States

District Court for the Northern District of Illinois relating to the transaction. This suit asserts claims under the

federal securities laws on behalf of a class of former Sears’ stockholders against Sears, Alan J. Lacy, Edward S.

Lampert and ESL Partners, L.P. for allegedly failing to make timely disclosure of merger discussions during the

period September 9 through November 16, 2004, and seeks damages. On July 17, 2007, the Court granted in part

and denied in part plaintiffs’ motion for class certification, certifying a class of Sears’ stockholders who sold

shares of Sears’ stock between September 9, 2004 and November 16, 2004, excluding short sellers who covered

their positions during the class period. On September 24, 2007, the Seventh Circuit Court of Appeals denied

defendants’ petition for leave to appeal the class certification order. Merits and expert discovery are concluded.

The Court has set the matter for a status hearing on May 1, 2009.

In re: Sears Holdings Corporation Securities Litigation—In May and July 2006, two class action lawsuits,

which each name as defendants Sears Holdings Corporation and Edward S. Lampert, were filed in United States

District Court for the Southern District of New York, purportedly on behalf of a class of persons that sold shares

of Kmart Holding Corporation stock on or after May 6, 2003 through June 4, 2004. The plaintiffs in each case

allege that Kmart’s Plan of Reorganization and Disclosure Statement filed on January 24, 2003 and amended on

February 25, 2003 misrepresented Kmart’s assets, particularly its real estate holdings, as evidenced by the prices

at which Kmart subsequently sold certain of its stores in June 2004 to Home Depot and Sears. The plaintiffs seek

damages for alleged misrepresentations. On December 19, 2006, the Court consolidated the actions and plaintiffs

filed their consolidated complaint. On April 15, 2008, the Court denied without prejudice defendants’ motion to

dismiss. After taking some additional discovery, defendants filed another motion to dismiss which remains

pending before the Court. The Court has set the pending motion for a hearing on March 17, 2009.

AIG Annuity Insurance Company, et al. v. Sears, Roebuck and Co. —On October 12, 2004, an action was

filed against Sears in the District Court, 192nd Judicial District, Dallas County, Texas by several holders of

certain bonds issued by Sears from 1991 through 1993. Plaintiffs purport to allege under theories of breach of

contract and misrepresentation, that Sears prematurely redeemed the bonds in 2004 following Sears’ sale of the

credit business in 2003. On February 2, 2007, a jury in the case reached a verdict against Sears and the Court

subsequently awarded plaintiffs $61 million plus post-judgment interest. Sears then filed a notice of appeal. On

89