Sears 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Foreign Currency Risk

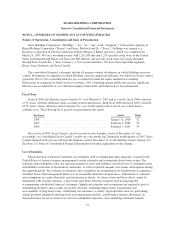

We, from time to time, enter into foreign currency forward contracts, which have typically been designated

and qualify as hedges of the foreign currency exposure of our net investment in Sears Canada. We had no such

foreign currency forward contracts outstanding as of January 31, 2009.

Sears Canada mitigates the risk of currency fluctuations on offshore merchandise purchases denominated in

U.S. currency by purchasing U.S. dollar denominated option contracts for a portion of its expected requirements.

As of January 31, 2009, these contracts had a notional value of approximately $457 million and a weighted

average remaining life of 0.8 years. The aggregate fair value of the option contracts as of January 31, 2009 was

$74 million. A hypothetical 1% adverse movement in the level of the Canadian exchange rate relative to the U.S.

dollar as of January 31, 2009, with all other variables held constant, would have resulted in a fair value for these

contracts of approximately $71 million as of January 31, 2009, a decrease of $3 million.

Counterparties

We actively manage the risk of nonpayment by our derivative counterparties by limiting our exposure to

individual counterparties based on credit ratings and maturities. The counterparties to these instruments are major

financial institutions with credit ratings of single-A or better. In certain cases, counterparty risk is also managed

through the use of collateral in the form of cash or U.S. government securities.

49