Sears 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

NOTE 3—ACQUISITION OF MINORITY INTEREST IN SEARS CANADA

During fiscal 2008, we increased our majority interest in Sears Canada from 70% to 73% by acquiring approximately

2.6 million common shares in open market transactions. We paid a total of $37 million for the additional shares acquired and

accounted for the acquisition of additional interest in Sears Canada as a purchase business combination. Total consideration for the

additional interest acquired exceeded the associated proportionate pre-acquisition carrying value for Sears Canada by

approximately $9 million, approximately all of which was allocated to goodwill.

During fiscal 2006, we increased our majority interest in Sears Canada from 54% to 70% by acquiring 17.8 million common

shares of Sears Canada pursuant to our take-over bid for Sears Canada, first announced in December 2005. We paid a total of $282

million for the additional 17.8 million common shares acquired and accounted for the acquisition of additional interest in Sears

Canada as a purchase business combination for accounting purposes. The total amount paid for shares acquired was allocated to the

assets acquired and liabilities assumed based on their estimated fair values as of the respective acquisition dates. Total

consideration for the additional interest acquired exceeded the associated proportionate pre-acquisition carrying value for Sears

Canada by $188 million. We allocated the excess to real property ($5 million), trademarks and other identifiable intangible assets

($55 million), goodwill ($167 million) and other assets and liabilities (-$39 million).

NOTE 4—BORROWINGS

Total borrowings outstanding at January 31, 2009 and February 2, 2008 were $2.9 billion and $3.0 billion, respectively. At

January 31, 2009, total short-term borrowings were $442 million, consisting of $435 million of secured borrowings and $7 million

of unsecured commercial paper. At February 2, 2008, total short-term borrowings were $162 million, consisting of $17 million of

secured borrowings and $145 million of unsecured commercial paper. The weighted-average annual interest rate paid on short-term

debt was 3.5% in fiscal 2008 and 5.5% in fiscal 2007.

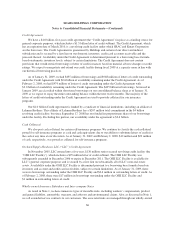

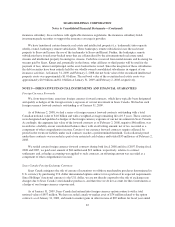

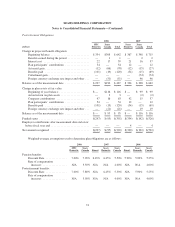

Long-term debt is as follows:

ISSUE

January 31,

2009

February 2,

2008

millions

SEARS ROEBUCK ACCEPTANCE CORP.

6.25% to 7.50% Notes, due 2009 to 2043 ................................................ $1,070 $1,123

5.20% to 7.50% Medium-Term Notes, due 2009 to 2013 .................................... 106 256

SEARS DC CORP.

9.07% to 9.20% Medium-Term Notes, due 2012 .......................................... 24 25

ORCHARD SUPPLY HARDWARE STORES CORPORATION

Commercial Mortgage-Backed Loan, variable interest rate above LIBOR, due 2009(1) ............ 120 120

Senior Secured Term Loan, variable rate of interest above LIBOR, due 2013(2) .................. 189 198

SEARS CANADA INC.

6.55% to 7.45% Debentures and Medium-Term Notes, due 2009 to 2010 ....................... 250 312

CAPITALIZED LEASE OBLIGATIONS ................................................... 664 749

OTHER NOTES AND MORTGAGES ...................................................... 54 65

Total long-term borrowings ............................................................... 2,477 2,848

Current maturities ...................................................................... (345) (242)

Long-term debt and capitalized lease obligations .............................................. $2,132 $2,606

Weighted-average annual interest rate on long-term debt ........................................ 6.9% 6.8%

(1) The Commercial Mortgage-Backed Loan is collateralized by certain real properties of our OSH wholly-owned subsidiary with

a total carrying value of approximately $173 million as of January 31, 2009. The term of the loan may be extended for up to

64