Sears 2008 Annual Report Download - page 23

Download and view the complete annual report

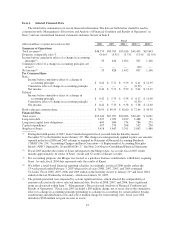

Please find page 23 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.diluted share) related to goodwill and asset impairments, store closings and severance, of which $360 million

($201 million after tax or $1.57 per diluted share) relates to non-cash items. These charges were partially offset

by mark-to-market gains on Sears Canada hedge transactions of $81 million ($33 million after tax and minority

interest or $0.26 per diluted share), the positive impact of the reversal of a $62 million ($37 million after tax or

$0.29 per diluted share) reserve because of the overturning of an adverse jury verdict relating to the redemption

of certain Sears, Roebuck and Co. bonds in 2004, a tax benefit of $8 million ($0.06 per diluted share) related to

the resolution of certain income tax matters, and gains on negotiated repurchases of debt securities prior to

maturity of $13 million ($8 million after tax or $0.06 per diluted share). Excluding the significant items above,

net income was $215 million, or $1.69 per diluted share, for the full year in fiscal 2008.

Net income for fiscal 2007 was $826 million, or $5.70 per diluted share. Fiscal 2007 results include the

impact of a gain of $19 million ($12 million after tax or $0.08 per diluted share) for insurance recoveries

received on hurricane claims filed for certain of our property damaged by hurricanes during fiscal 2005 and a

curtailment gain of $27 million ($17 million after tax or $0.12 per diluted share) related to certain amendments

made to Sears Canada’s post-retirement benefit plans. These gains were partially offset by losses of $14 million

($9 million after tax or $0.06 per diluted share) on our total return swap investments. Excluding the significant

items above, net income was $806 million, or $5.56 per diluted share, in fiscal 2007.

Excluding the items noted above, net income decreased $591 million during fiscal 2008. The decrease in net

income for the year reflects a decrease in operating income of $1.3 billion (or $863 million excluding the impact

of certain items noted above), primarily due to lower operating income at Kmart and Sears Domestic, as well as

slightly lower operating income at Sears Canada. The decrease in net income was also due to lower interest and

investment income, partially offset by lower income tax expense.

Declines in the operating results of Sears Domestic and Kmart are primarily the result of a decline in gross

margin across most major merchandise categories, reflecting both sales declines as well as an overall decline in

our gross margin rate for the year due to increased markdowns taken across most merchandise categories and

reduced leverage of buying and occupancy costs. During 2008, we made a concerted effort to reduce our

inventory levels due to the deterioration of the economic climate in the latter half of 2007 and what we

anticipated to be a higher risk environment in 2008.

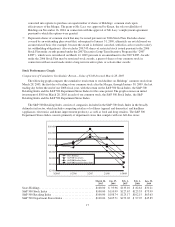

Total Revenues and Comparable Store Sales

Total revenues for fiscal 2008 were $46.8 billion, as compared to revenues of $50.7 billion for fiscal 2007.

The decline in revenues of $3.9 billion is primarily due to a $2.5 billion decline at Sears Domestic, a $1.0 billion

decline at Kmart, and a $366 million decline at Sears Canada, which includes a decrease of $96 million related to

the impact of exchange rates during fiscal 2008. Exchange rates did not have as significant an impact on the

results of Sears Canada in 2008 as compared to 2007, as rates were less volatile during the current year. The

decrease in fiscal 2008 revenues as compared to fiscal 2007 was primarily due to the impact of lower comparable

store sales at Kmart and Sears Domestic.

Fiscal 2008 domestic comparable store sales were down 8.0% in the aggregate, with Sears Domestic

declining 9.5% and Kmart declining 6.1%. In fiscal 2008, declines were experienced across most major

merchandise categories. Domestic comparable store sales declines continue to be driven by categories most

directly impacted by housing market conditions (including a high single digit percentage decline in home

appliances at Sears Domestic) and a slowdown in consumers’ discretionary spending (including a high single

digit percentage decline in home goods, a mid single digit percentage decline in apparel at Kmart, high single

digit percentage declines in home and household goods at Sears Domestic, and a low double digit percentage

decline in apparel, tools, and lawn and garden at Sears Domestic). If the overall retail environment continues to

be impacted by unfavorable economic factors, our sales will likely continue to be pressured in fiscal 2009.

23