Sears 2008 Annual Report Download - page 90

Download and view the complete annual report

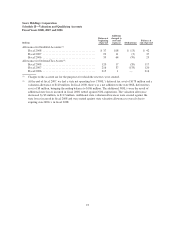

Please find page 90 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

August 21, 2008, the appellate court reversed the trial court’s judgment and entered judgment in favor of Sears on all

counts. Plaintiffs’ subsequent motion for rehearing was denied. The deadline for filing a petition for review with the

Texas Supreme Court is April 4, 2009.

As previously reported in Kmart’s Annual Report on Form 10-K for its fiscal year ended January 26, 2005, the

staff of the Securities and Exchange Commission has been investigating, and the U.S. Attorney for the Eastern District

of Michigan has undertaken an inquiry into, the manner in which Kmart recorded vendor allowances before a change in

accounting principles at the end of fiscal 2001 and the disclosure of certain events bearing on the Predecessor

Company’s liquidity in the fall of 2001. Kmart has cooperated with the SEC and the U.S. Attorney’s office with

respect to these matters, which are ongoing.

On August 23, 2005, the SEC filed a complaint in the United States District Court for the Eastern District of

Michigan against the Predecessor Company’s former chief executive officer and its former chief financial officer

alleging that they misled investors about the Predecessor Company’s liquidity and related matters in the months

preceding its bankruptcy in violation of federal securities law. The complaint seeks permanent injunctions,

disgorgement with interest, civil penalties and officer and director bars. Kmart is not named as a defendant in the

action. In its press release announcing the filing of the complaint, the SEC stated that its Kmart investigation is

continuing.

We are a defendant in several lawsuits containing class-action allegations in which the plaintiffs are current and

former hourly and salaried associates who allege various wage and hour violations and unlawful termination practices.

The complaints generally seek unspecified monetary damages, injunctive relief, or both. Further, certain of these

proceedings are in jurisdictions with reputations for aggressive application of laws and procedures against corporate

defendants. One of these class-action lawsuits described above is Moldowan, et al. v. Sears, Roebuck and Company, et

al., a lawsuit filed on August 12, 2004 in the Superior Court of the State of California, County of Sonoma in which

plaintiffs allege that Sears failed to pay them for all hours worked and otherwise failed to pay them correctly for work

performed in accordance with California law. Plaintiffs seek monetary damages in an unspecified amount, together

with attorneys’ fees, interest, statutory penalties and punitive damages. The parties have settled the matter and

plaintiffs have filed a motion for preliminary approval of the settlement. In agreeing to the settlement, defendants did

not admit any wrongdoing and denied committing any violation of law. Defendants agreed to the settlement solely to

eliminate the uncertainties, burden and expense of further protracted litigation. We previously established a reserve for

the expected settlement and it will not have a material adverse effect on our annual results of operations, financial

position, liquidity or capital resources.

We are subject to various other legal and governmental proceedings, many involving litigation incidental to our

businesses. Some matters contain class action allegations, environmental and asbestos exposure allegations and other

consumer-based claims, each of which may seek compensatory, punitive or treble damage claims (potentially in large

amounts) or as well as other types of relief.

In accordance with SFAS No. 5, “Accounting for Contingencies,” we accrue an undiscounted liability for those

contingencies where the incurrence of a loss is probable and the amount can be reasonably estimated and we do not

record liabilities when the likelihood that the liability has been incurred is probable but the amount cannot be

reasonably estimated, or when the liability is believed to be only reasonably possible or remote. Because litigation

outcomes are inherently unpredictable, these assessments often involve a series of complex assessments by

management about future events and can rely heavily on estimates and assumptions. While the consequences of certain

unresolved proceedings are not presently determinable, an adverse outcome from certain matters could have a material

adverse effect on our earnings in any given reporting period. However, in the opinion of our management after

consulting with legal counsel, and taking into account insurance and reserves, the ultimate liability is not expected to

have a material adverse effect on our financial position, liquidity or capital resources.

90