Sears 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

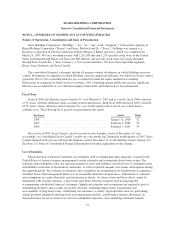

We account for income taxes under SFAS No. 109, “Accounting for Income Taxes,” and FASB

Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes—an Interpretation of FASB

Statement No. 109.” Deferred tax assets and liabilities are recognized for the future tax consequences attributable

to differences between the book basis and tax basis of assets and liabilities. Deferred tax assets and liabilities are

measured using enacted tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled. If future utilization of deferred tax assets is uncertain, the

Company may record a valuation allowance against certain deferred tax assets.

Prior to the adoption of FIN 48 on February 4, 2007, we recorded tax contingencies based on the accounting

guidance set forth in SFAS No. 5, which requires a contingency to be both probable and reasonably estimable for

a loss to be recorded. Upon adoption of FIN 48, Holdings began recording unrecognized tax benefits for

positions taken or expected to be taken on tax returns, including the decision to exclude certain income or

transactions from a return, when a more-likely-than-not threshold is met for a tax position and management

believes that the position will be sustained upon examination by the taxing authorities. In accordance with FIN

48, we record the largest amount of the unrecognized tax benefit that is greater than 50% likely of being realized

upon settlement. Management evaluates each position based solely on the technical merits and facts and

circumstances of the position, assuming the position will be examined by a taxing authority having full

knowledge of all relevant information. Significant management judgment is required to determine whether the

recognition threshold has been met and, if so, the appropriate amount of unrecognized tax benefits to be recorded

in the Consolidated Financial Statements. Management reevaluates tax positions each period in which new

information about recognition or measurement becomes available.

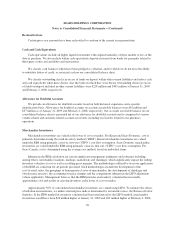

Significant management judgment is required in determining our provision for income taxes, deferred tax

assets and liabilities and the valuation allowance recorded against our net deferred tax assets, if any. In assessing

the likelihood of realization of deferred tax assets, management considers estimates of the amount and character

of future taxable income. Our actual effective tax rate and income tax expense could vary from estimated

amounts due to the future impacts of various items, including changes in income tax laws, tax planning and the

Company’s forecasted financial condition and results of operations in future periods. Although management

believes current estimates are reasonable, actual results could differ from these estimates.

Domestic and foreign tax authorities periodically audit our income tax returns. These audits include

questions regarding our tax filing positions, including the timing and amount of deductions and the allocation of

income among various tax jurisdictions. In evaluating the exposures associated with our various tax filing

positions we record reserves in accordance with the provisions of FIN 48. A number of years may elapse before a

particular matter, for which we have established a reserve, is audited and fully resolved. Management’s estimates

as of the date of the financial statements reflect our best judgment giving consideration to all currently available

facts and circumstances. As such, these estimates may require adjustment in the future, as additional facts

become known or as circumstances change. For further information, see Note 11 of Notes to Consolidated

Financial Statements.

Goodwill and Intangible Asset Impairment Assessments

At January 31, 2009 and February 2, 2008 we had goodwill and intangible asset balances of $4.7 billion and

$5.1 billion, respectively. Holdings evaluates the carrying value of goodwill and intangible assets for possible

impairment under SFAS No. 142, “Goodwill and Other Intangible Assets.” The majority of our goodwill and

intangible assets relate to Kmart’s acquisition of Sears, Roebuck and Co. in March 2005. The remaining goodwill

amounts were recorded as part of our subsequent acquisitions of additional minority interest in Sears Canada. We

allocate goodwill, which is defined as the total purchase price less the fair value of all assets and liabilities

acquired, to reporting units as of the acquisition date. As required by SFAS No. 142, we perform annual goodwill

and intangible impairment tests in the fourth quarter and update the tests between annual tests if events or

circumstances occur that would more likely than not reduce the fair value of a reporting unit below its carrying

amount.

46