Sears 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

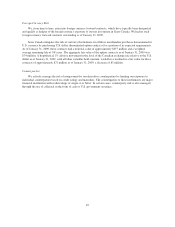

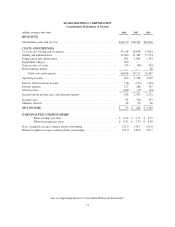

SEARS HOLDINGS CORPORATION

Consolidated Statements of Shareholders’ Equity

dollars and shares in millions

Number of

Shares

Common

Stock

Treasury

Stock

Capital in

Excess of

Par Value

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss) Total

Balance, beginning of January 28, 2006 ........ 160 $ 2 $ (642) $10,258 $2,197 $(208) $11,607

Comprehensive income

Net income .......................... — — — — 1,492 — 1,492

Minimum pension liability adjustment, net

oftax ............................. — — — — — 174 174

Deferred loss on derivatives ............. — — — — — (1) (1)

Cumulative translation adjustment ........ — — — — — 19 19

Total Comprehensive Income ................ 1,684

Adjustment to initially apply FAS 158, net of

tax ................................... — — — — — 75 75

Pre-petition tax settlements/valuation reserve

adjustments ............................ — — — 130 — — 130

Bankruptcy related settlement agreements ...... — — — 4 — — 4

Shares repurchased ........................ (6) — (816) — — — (816)

Other ................................... — — 21 1 — — 22

Balance at February 3, 2007 ................. 154 2 (1,437) 10,393 3,689 59 12,706

Comprehensive income

Net income .......................... — — — — 826 — 826

Pension and postretirement adjustments, net

oftax ............................. — — — — — 53 53

Deferred gain on derivatives ............. — — — — — 1 1

Cumulative translation adjustment ........ — — — — — (44) (44)

Total Comprehensive Income ................ 836

Stock awards ............................. — — 54 (30) — — 24

Pre-petition tax settlements/valuation reserve

adjustments ............................ — — — 52 — — 52

Bankruptcy related settlement agreements ...... — — (29) 4 — — (25)

Shares repurchased ........................ (22) (1) (2,921) — — — (2,922)

Other ................................... — — 2 (6) — (4)

Balance at February 2, 2008 ................. 132 1 (4,331) 10,419 4,509 69 10,667

Comprehensive income (loss)

Net income .......................... — — — — 53 — 53

Pension and postretirement adjustments, net

oftax ............................. — — — — — (604) (604)

Cumulative translation adjustment ........ — — — — — (77) (77)

Total Comprehensive Income (Loss) .......... (628)

Stock awards ............................. — — 2 (8) — — (6)

Pre-petition tax settlements .................. — — — 23 — — 23

Bankruptcy related settlement agreements ...... — — (12) 7 — — (5)

Shares repurchased ........................ (10) — (678) — — — (678)

Associate stock purchase ................... — — 7 — — — 7

Balance at January 31, 2009 ................. 122 $ 1 $(5,012) $10,441 $4,562 $(612) $ 9,380

See accompanying Notes to Consolidated Financial Statements.

54