Sears 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

fiscal years beginning on or after December 15, 2008, with early adoption prohibited. Before SFAS No. 160 was

issued, limited guidance existed for reporting noncontrolling interests and many companies reported such interest

as a liability in its balance sheet under the heading “Minority Interest.” SFAS No. 160 requires companies to

report noncontrolling interests of consolidated subsidiaries as a component of equity in the consolidated

statement of financial position. As a result, upon adoption of this Statement, Holdings will reclassify its

noncontrolling interest in Sears Canada and OSH (which represents 27% and 19.9% of the subsidiaries’

ownership, respectively) from its current classification within the long-term liabilities section of Holdings’

consolidated balance sheet to classification within the shareholders’ equity section. See Note 17 for the amount

of Holdings’ noncontrolling interest in Sears Canada and OSH (reported as Minority Interest) at January 31, 2009

and February 2, 2008.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging

Activities, an amendment of SFAS No. 133, Accounting for Derivative Instruments and Hedging

Activities.” SFAS No. 161 expands the disclosure requirements of SFAS No. 133 to require entities to make

qualitative disclosures regarding objectives and strategies for using derivatives, quantitative disclosures regarding

fair value amounts of and gains and losses on derivative instruments, and disclosures regarding credit-risk-related

contingent features in derivative instruments. SFAS No. 161 is effective for fiscal years beginning after

November 15, 2008 and we plan to adopt this standard beginning in the first quarter of fiscal 2009. As this

statement relates only to disclosure requirements, we do not expect it to have a material impact on our financial

condition or operating results.

In December 2008, the FASB issued FSP FAS No. 132(R)-1, “Employers’ Disclosures about Postretirement

Benefit Plan Assets,” which requires additional disclosures for employers’ pension and other postretirement

benefit plan assets. As pension and other postretirement benefit plan assets were not included within the scope of

SFAS No. 157, the FSP requires employers to disclose information about fair value measurements of plan assets

similar to the disclosures required under SFAS No. 157, the investment policies and strategies for the major

categories of plan assets, and significant concentrations of risk within plan assets. FSP FAS 132(R)-1 is effective

for fiscal years ending after December 15, 2009. As FSP FAS 132(R)-1 provides only disclosure requirements,

the adoption of this standard will not have a material impact on our financial condition or operating results.

NOTE 2—CHANGES IN ACCOUNTING PRINCIPLE

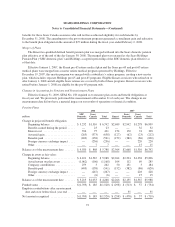

Change in Sears Canada Year End

During the fourth quarter of 2007, Sears Canada changed its fiscal year end from the Saturday nearest to

December 31st to the Saturday nearest to January 31st. Prior to this change, Sears Canada’s results were

consolidated into the consolidated results of Holdings on a one-month lag. While our historical policy of

consolidating the results of Sears Canada on a one-month lag was considered acceptable, the elimination of the

one-month reporting lag was considered preferable because it allows a full seasonal cycle, including the

liquidation of holiday merchandise, for Sears Canada to be included in the results of Holdings. Furthermore,

Sears Canada’s fiscal year end is now aligned with the fiscal year end of Holdings.

In accordance with SFAS No. 154, “Accounting Changes and Error Corrections—A Replacement of APB

Opinion No. 20 and SFAS No. 3,” changes in accounting policy are to be reported through retrospective

application of the new policy to all prior financial statement periods presented. Accordingly, the Company’s

financial statements for periods prior to 2007 have been adjusted to reflect the period-specific effects of applying

this change. This change resulted in a one-month shift backwards of periods previously reported for Sears

Canada. The impact of this change in accounting policy was not material to the Company’s consolidated

financial position, results of operations or cash flows for fiscal 2007 or 2006. See Note 20 for the impact of this

change to the Company’s quarterly results of operations for 2007.

63