Sears 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Depreciation and Amortization

Depreciation and amortization expense was $802 million and $927 million for fiscal 2007 and fiscal 2006,

respectively. The decrease in fiscal 2007 is primarily attributable to additional property and equipment becoming

fully depreciated during the year, thereby decreasing our depreciable asset base.

Operating Income

For fiscal 2007, Sears Domestic’s operating income decreased $539 million to $784 million, as compared to

$1.3 billion in fiscal 2006. The decrease primarily reflects lower total gross margin dollars generated as a result

of lower overall sales levels and a decline in gross margin rate as a result of markdowns taken to clear excess

levels of inventory. The impact of these items was offset by $125 million decline in depreciation and

amortization expense.

Sears Canada

Sears Canada, a consolidated, 73%-owned subsidiary of Sears, conducts similar retail operations as Sears

Domestic. During the fourth quarter of fiscal 2007, Sears Canada changed its fiscal year end from the Saturday

nearest December 31st to the Saturday nearest January 31st. This change has been retrospectively applied to prior

year amounts as required by SFAS No. 154, “Accounting Changes and Error Corrections—A Replacement of

APB Opinion No. 20 and SFAS No. 3.” See Note 2 to the Consolidated Financial Statements for further

explanation of this change.

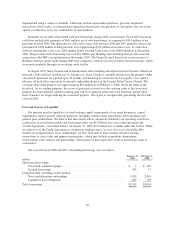

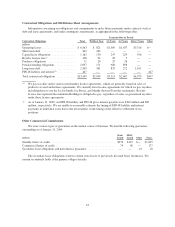

Sears Canada results and key statistics were as follows:

millions, except for number of stores 2008 2007 2006

Merchandise sales and services ........................................... $5,236 $5,602 $5,190

Cost of sales, buying and occupancy ....................................... 3,592 3,847 3,643

Gross margin dollars ................................................... 1,644 1,755 1,547

Gross margin rate ..................................................... 31.4% 31.3% 29.8%

Selling and administrative ............................................... 1,189 1,233 1,131

Selling and administrative expense as a percentage of total revenues ............. 22.7% 22.0% 21.8%

Depreciation and amortization ............................................ 119 131 139

Gain on sales of assets .................................................. (31) (9) —

Restructuring charges ................................................... — — 19

Total costs and expenses ............................................ 4,869 5,202 4,932

Operating income ...................................................... $ 367 $ 400 $ 258

Number of:

Full-line Stores .................................................... 122 121 123

Specialty Stores ................................................... 266 259 250

Total Sears Canada Stores ............................................... 388 380 373

Fiscal 2008 Compared to Fiscal 2007

Total Revenues

Sears Canada’s total revenues decreased by $366 million, or 6.5%, to $5.2 billion for fiscal 2008 as

compared to the same period last year. The decrease in total revenues includes a $96 million decline due to the

impact of unfavorable exchange rates during the year. On an equivalent Canadian dollar basis, revenues

decreased by $270 million, primarily reflecting an decrease in Sears Canada’s sales at their Full-line, Home,

Outlet, and Direct formats as compared to fiscal 2007. These declines were partially offset by an increase in

revenues from services and credit programs.

35