Sears 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

January 31, 2009. The asset and corresponding gains recorded on these option contracts were partially offset by a

liability of $6 million and losses of $6 million for the fiscal year ended January 31, 2009 related to the change in

the fair value of the embedded derivative in the merchandise purchase contracts. We did not have any such

currency option contracts outstanding as of February 2, 2008 and the embedded derivative in merchandise

purchase contracts had a nominal fair value as of February 2, 2008.

Total Return Swaps

We have, from time to time, invested our surplus cash in various securities and financial instruments,

including total return swaps, which are derivative instruments designed to synthetically replicate the economic

return characteristics of one or more underlying marketable equity securities. Such investments may be highly

concentrated and involve substantial risks and may require us to post cash collateral as a percentage of the

notional amount of the underlying position. We had no total return swaps outstanding at any point during fiscal

2008. We recognized investment losses of $14 million on total return swaps during fiscal 2007 and investment

gains of $74 million during fiscal 2006.

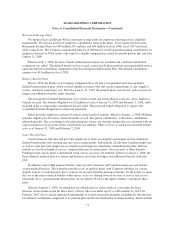

SFAS No. 157, “Fair Value Measurements”

On February 3, 2008, we adopted SFAS No. 157, “Fair Value Measurements.” The adoption of SFAS

No. 157 is currently limited to financial instruments and to non-financial derivatives as, in February 2008, the

Financial Accounting Standards Board (“FASB”) issued FSP No. 157-2, which delayed the effective date of

SFAS No. 157 for one year for nonfinancial assets and liabilities, except for items that are recognized or

disclosed at fair value in the financial statements on a recurring basis. The adoption of SFAS No. 157 had no

impact on our financial position or results of operations.

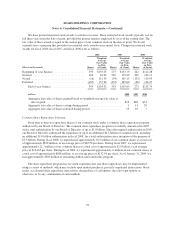

We determine fair value of financial assets and liabilities based on the following fair value hierarchy, as

prescribed by SFAS No. 157, which prioritizes the inputs to valuation techniques used to measure fair value into

three levels:

Level 1 inputs—unadjusted quoted prices in active markets for identical assets or liabilities that we have

the ability to access. An active market for the asset or liability is one in which transactions for the asset or

liability occur with sufficient frequency and volume to provide ongoing pricing information.

Level 2 inputs—inputs other than quoted market prices included in Level 1 that are observable, either

directly or indirectly, for the asset or liability. Level 2 inputs include, but are not limited to, quoted prices

for similar assets or liabilities in an active market, quoted prices for identical or similar assets or liabilities in

markets that are not active and inputs other than quoted market prices that are observable for the asset or

liability, such as interest rate curves and yield curves observable at commonly quoted intervals, volatilities,

credit risk and default rates.

Level 3 inputs—unobservable inputs for the asset or liability.

68