Sears 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

one additional year. As management of OSH has both the ability and intent to extend the term for an

additional year, we have classified the carrying value of this loan within long-term debt and capitalized

lease obligations on our consolidated balance sheet as of January 31, 2009 and have included the principal

amount due under the loan within fiscal 2010 maturities for purposes of the below schedule of long-term

debt maturities.

(2) In December 2006, a subsidiary of OSH generated $198 million of debt proceeds, net of approximately $2

million in issuance costs, in connection with its entering into a five year, $200 million Senior Secured Term

Loan. The proceeds of this borrowing were used by OSH to pay Holdings the remaining loan payable issued

in connection with OSH’s recapitalization in November 2005. The Senior Secured Term Loan is

non-recourse to Holdings. The Senior Secured Term Loan is collateralized by a priority interest in all

non-real estate assets of OSH and a second lien on OSH’s inventory, and requires quarterly repayments

equal to 0.25% of the then outstanding principal balance.

The fair value of long-term debt and capitalized lease obligations was $1.7 billion and $2.5 billion at

January 31, 2009 and February 2, 2008, respectively. The fair value of our debt was estimated based on quoted

market prices for the same or similar issues or on current rates offered to us for debt of the same remaining

maturities.

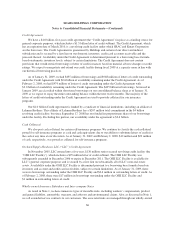

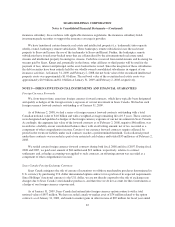

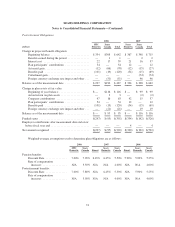

As of January 31, 2009, long-term debt maturities for the next five years and thereafter were as follows:

millions

2009 .............................................................. $ 345

2010 .............................................................. 443

2011 .............................................................. 492

2012 .............................................................. 191

2013 .............................................................. 99

Thereafter .......................................................... 907

$2,477

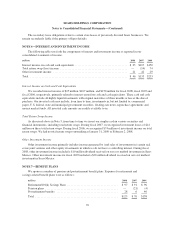

Interest

millions 2008 2007 2006

COMPONENTS OF INTEREST EXPENSE

Interest expense ................................................. $243 $253 $281

Accretion of obligations at net present value .......................... 24 26 45

Amortization of debt issuance costs .................................579

Interest expense ................................................. $272 $286 $335

Debt Repurchase Authorization

In fiscal 2005, our Finance Committee of the Board of Directors authorized the repurchase, subject to

market conditions and other factors, of up to $500 million of our outstanding indebtedness in open market or

privately negotiated transactions. Our wholly-owned finance subsidiary, Sears Roebuck Acceptance Corp.

(“SRAC”), has repurchased $209 million of its outstanding notes, including $49 million repurchased during

fiscal 2008, thereby reducing the unused balance of this authorization to $291 million.

65