Sears 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

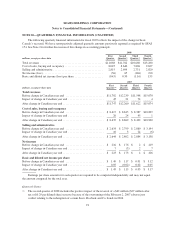

millions

January 31,

2009

February 2,

2008

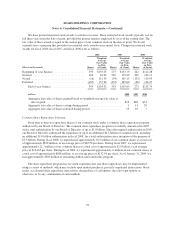

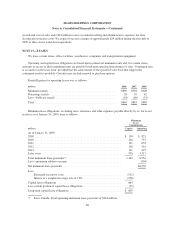

Deferred tax assets and liabilities

Deferred tax assets:

Federal benefit for state and foreign taxes ................................. $ 143 $ 156

Accruals and other liabilities ........................................... 309 357

Capital leases ....................................................... 169 182

NOL carryforwards ................................................... 280 274

OPEB ............................................................. 169 229

Pension/Minimum pension ............................................. 582 283

Deferred revenue ..................................................... 191 204

Credit carryforwards .................................................. 108 66

Other .............................................................. 185 243

Total deferred tax assets ................................................... 2,136 1,994

Valuation allowance ...................................................... (117) (120)

Net deferred tax assets ................................................ 2,019 1,874

Deferred tax liabilities:

Trade names/Intangibles ............................................... 1,203 1,245

Property and equipment ............................................... 206 214

Inventory ........................................................... 246 326

Other .............................................................. 178 281

Total deferred tax liabilities ................................................ 1,833 2,066

Net deferred tax asset (liability) ............................................. $ 186 $ (192)

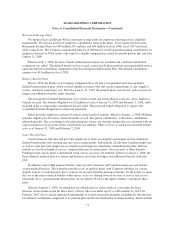

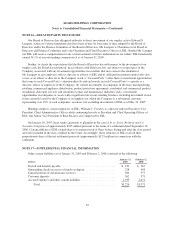

The Deferred Tax Asset and Liability table above for fiscal 2008 reflects the deferred tax assets and

liabilities net of the federal benefit of state due to the implementation of a new tax provision software system in

fiscal 2008. We reclassified fiscal 2007 deferred tax assets and liabilities above to reflect the net deferred tax

consequences of each line item.

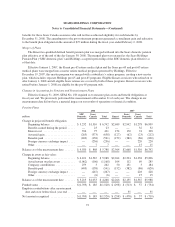

We account for income taxes in accordance with SFAS No. 109, “Accounting for Income Taxes,” which

requires that deferred tax assets and liabilities be recognized using enacted tax rates for the effect of temporary

differences between the financial reporting and tax bases of recorded assets and liabilities. SFAS No. 109 also

requires that deferred tax assets be reduced by a valuation allowance if it is more likely than not that some

portion of or all of the deferred tax asset will not be realized.

During fiscal 2008, we reduced our reserves for Predecessor Company income tax liabilities by $1 million,

primarily due to favorable claims settlements. In fiscal years 2008 and 2007, we also received a tax benefit of

$23 million and $32 million, respectively, relating to certain Class 5 and 6 pre-petition claims paid with equity.

In accordance with SOP 90-7, subsequent to emergence from Chapter 11, any benefit realized from an

adjustment to pre-confirmation income tax liabilities is recorded as an addition to Capital in excess of par value.

At January 31, 2009, we had Federal net operating loss (“NOL”) carryforwards from the Predecessor

Company of approximately $269 million subject to an overall annual section 382 limitation of $96 million,

generating deferred tax assets of approximately $94 million. The federal NOL carryforwards will expire in 2021,

2022, 2023, and 2028. We also have credit carryforwards of $108 million, which will expire between 2015 and

2028.

81