Sears 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

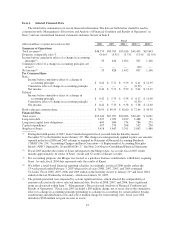

Business Segment Results

Kmart

Kmart results and key statistics were as follows:

millions, except for number of stores 2008 2007 2006

Merchandise sales and services ........................................ $16,219 $17,256 $18,647

Cost of sales, buying and occupancy .................................... 12,442 13,202 14,061

Gross margin dollars ................................................ 3,777 4,054 4,586

Gross margin rate .................................................. 23.3% 23.5% 24.6%

Selling and administrative ............................................ 3,456 3,537 3,623

Selling and administrative expense as a percentage of total revenues .......... 21.3% 20.5% 19.4%

Depreciation and amortization ......................................... 138 116 77

Impairment charges ................................................. 21 — —

Gain on sales of assets ............................................... (10) (1) (71)

Restructuring charges ................................................ — — 9

Total costs and expenses ......................................... 16,047 16,854 17,699

Operating income ................................................... $ 172 $ 402 $ 948

Total Kmart Stores .................................................. 1,368 1,382 1,388

Fiscal 2008 Compared to Fiscal 2007

Total Revenues and Comparable Store Sales

Comparable store sales and total sales decreased 6.1% and 6.0%, respectively, during fiscal 2008. The 6.1%

decline in Kmart comparable store sales during fiscal 2008 compares to a 4.7% decline in comparable store sales

recorded for fiscal 2007. Comparable store sales declines were driven by mid to high single digit declines

recorded within the apparel and home categories. We believe the overall decline in comparable store sales

reflects the negative impact of certain external economic factors, as noted above in the discussion of Holdings’

consolidated results.

Gross Margin

Kmart generated $3.8 billion in total gross margin in fiscal 2008, as compared to $4.1 billion in fiscal 2007.

The $277 million decline includes a charge of $15 million recorded to markdown inventory in connection with

store closings announced during the third and fourth quarters of 2008 and primarily reflects the negative gross

margin impact of lower overall sales, as well as a decline in Kmart’s gross margin rate. Kmart’s gross margin

rate was 23.3%, as compared to 23.5% in fiscal 2007, a decrease of 0.2%. The decrease in Kmart’s gross margin

rate is due to an increase of 0.5% in buying and occupancy costs (which are more fixed in nature) as a percentage

of sales, offset by an increase in margin related to lower royalties paid on select merchandise.

Selling and Administrative Expenses

Fiscal 2008 selling and administrative expenses decreased $81 million as compared to fiscal 2007. The

decline in selling and administrative expenses mainly reflects a $68 million reduction in payroll expenses as well

as a $14 million reduction in advertising costs. These reductions were partially offset by expenses incurred for

certain store closing and severance costs of $12 million. Our selling and administrative expense rate was 21.3%

for fiscal 2008, as compared to 20.5% for fiscal 2007, and increased primarily as a result of lower expense

leverage given lower overall sales.

29