Sears 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

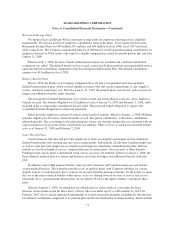

insurance subsidiary. In accordance with applicable insurance regulations, the insurance subsidiary holds

investment grade securities to support the insurance coverage it provides.

We have transferred certain domestic real estate and intellectual property (i.e. trademarks) into separate

wholly-owned, bankruptcy remote subsidiaries. These bankruptcy remote subsidiaries lease the real estate

property to Sears and license the use of the trademarks to Sears and Kmart. Further, the bankruptcy remote

subsidiaries have issued asset-backed notes that are collateralized by the aforementioned real estate rental

streams and intellectual property licensing fee streams. Cash flows received from rental streams and licensing fee

streams paid by Sears, Kmart and, potentially in the future, other affiliates or third parties will be used for the

payment of fees, interest and principal on the asset-backed notes issued. Since the inception of these subsidiaries,

the debt securities have been entirely held by our wholly-owned consolidated subsidiaries in support of our

insurance activities. At January 31, 2009 and February 2, 2008, the net book value of the securitized intellectual

property assets was approximately $1.0 billion. The net book value of the securitized real estate assets was

approximately $0.9 billion and $1.0 billion at January 31, 2009 and February 2, 2008, respectively.

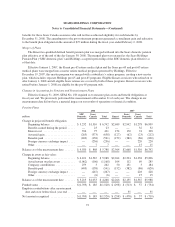

NOTE 5—DERIVATIVE FINANCIAL INSTRUMENTS AND FINANCIAL GUARANTEES

Foreign Currency Forwards

We, from time to time, enter into foreign currency forward contracts, which have typically been designated

and qualify as hedges of the foreign currency exposure of our net investment in Sears Canada. We had no such

foreign currency forward contracts outstanding as of January 31, 2009.

As of February 2, 2008, we had a series of foreign currency forward contracts outstanding with a total

Canadian notional value of $1.0 billion and with a weighted-average remaining life of 0.3 years. These contracts

were designated and qualified as hedges of the foreign currency exposure of our net investment in Sears Canada.

Accordingly, the aggregate fair value of the forward contracts as of February 2, 2008, negative $86 million, was

recorded as a liability on our consolidated balance sheet, with an offsetting amount, net of tax, recorded as a

component of other comprehensive income. Certain of our currency forward contracts require collateral be

posted in the event our liability under such contracts reaches a predetermined threshold. Cash collateral posted

under these contracts was recorded as part of our restricted cash balance and totaled $33 million as of February 2,

2008.

We settled certain foreign currency forward contracts during both fiscal 2008 and fiscal 2007. During fiscal

2008 and 2007, we paid a net amount of $64 million and $12 million, respectively, relative to contract

settlements and, as hedge accounting was applied to such contracts, an offsetting amount was recorded as a

component of other comprehensive income.

Sears Canada Foreign Exchange Contracts

Sears Canada mitigates the risk of currency fluctuations on offshore merchandise purchases denominated in

U.S. currency by purchasing U.S. dollar denominated option contracts for a portion of its expected requirements.

Since Holdings’ functional currency is the U.S. dollar, we are not directly exposed to the risk of exchange rate

changes due to Sears Canada’s merchandise purchases, and therefore we do not account for these instruments as

a hedge of our foreign currency exposure risk.

As of January 31, 2009, Sears Canada had entered into foreign currency option contracts with a total

notional value of $457 million. We have recorded a mark-to-market asset of $74 million related to the option

contracts as of January 31, 2009, and mark-to-market gains in other income of $87 million for fiscal year ended

67