Sears 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

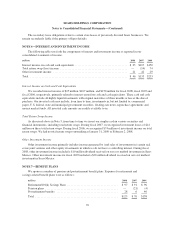

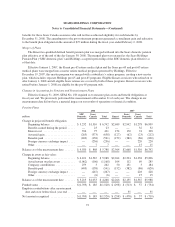

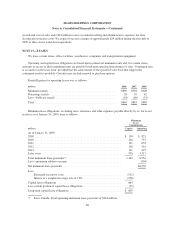

For 2009 and beyond, the domestic weighted-average health care cost trend rates used in measuring the

postretirement benefit expense are an 8.3% trend rate in 2009 to an ultimate trend rate of 8.0% in 2013. A

one-percentage-point change in the assumed health care cost trend rate would have the following effects on the

postretirement liability:

millions

1 percentage-point

Increase

1 percentage-point

Decrease

Effect on total service and interest cost

components ................................ $ 1 $ (1)

Effect on postretirement benefit obligation ......... $14 $(13)

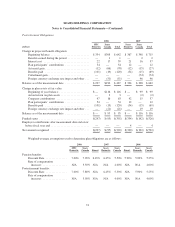

$64 million of the unrecognized net gains in accumulated other comprehensive income are expected to be

amortized as a component of net periodic benefit cost during fiscal 2009.

Information regarding expected future cash flows for our benefit plans is as follows:

millions

SHC

Domestic

Sears

Canada Total

Pension benefits:

Employer contributions:

Fiscal 2009 (expected) ......................................... $ 171 $ 5 $ 176

Expected benefit payments:

Fiscal 2009 ...................................................... $ 332 $ 86 $ 418

Fiscal 2010 ...................................................... 337 88 425

Fiscal 2011 ...................................................... 344 90 434

Fiscal 2012 ...................................................... 377 92 469

Fiscal 2013 ...................................................... 383 95 478

Fiscal 2014-2018 .................................................. 2,003 497 2,500

Postretirement benefits:

Employer contributions:

Fiscal 2009 (expected) ......................................... $ 39 $ 12 $ 51

Expected benefit payments:

Fiscal 2009 ...................................................... $ 39 $ 15 $ 54

Fiscal 2010 ...................................................... 37 16 53

Fiscal 2011 ...................................................... 35 16 51

Fiscal 2012 ...................................................... 33 17 50

Fiscal 2013 ...................................................... 31 17 48

Fiscal 2014-2018 .................................................. 129 88 217

76