Sears 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

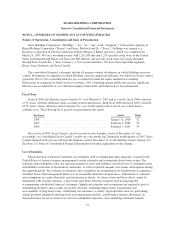

Notes to Consolidated Financial Statements—(Continued)

Reclassifications

Certain prior year amounts have been reclassified to conform to the current year presentation.

Cash and Cash Equivalents

Cash equivalents include all highly liquid investments with original maturities of three months or less at the

date of purchase. We also include within cash equivalents deposits in-transit from banks for payments related to

third-party credit card and debit card transactions.

We classify cash balances which have been pledged as collateral, and for which we do not have the ability

to substitute letters of credit, as restricted cash on our consolidated balance sheet.

We classify outstanding checks in excess of funds on deposit within other current liabilities and reduce cash

and cash equivalents when these checks clear the bank on which they were drawn. Outstanding checks in excess

of funds on deposit included in other current liabilities were $228 million and $405 million at January 31, 2009

and February 2, 2008, respectively.

Allowance for Doubtful Accounts

We provide an allowance for doubtful accounts based on both historical experience and a specific

identification basis. Allowances for doubtful accounts on accounts receivable balances were $42 million and

$37 million as of January 31, 2009 and February 2, 2008, respectively. Our accounts receivable balance on our

consolidated balance sheet is presented net of our allowance for doubtful accounts and is comprised of various

vendor-related and customer-related accounts receivable, including receivables related to our pharmacy

operations.

Merchandise Inventories

Merchandise inventories are valued at the lower of cost or market. For Kmart and Sears Domestic, cost is

primarily determined using the retail inventory method (“RIM”). Kmart merchandise inventories are valued

under the RIM using primarily a first-in, first-out (“FIFO”) cost flow assumption. Sears Domestic merchandise

inventories are valued under the RIM using primarily a last-in, first-out (“LIFO”) cost flow assumption. For

Sears Canada, cost is determined using the average cost method, based on individual items.

Inherent in the RIM calculation are certain significant management judgments and estimates including,

among others, merchandise markons, markups, markdowns and shrinkage, which significantly impact the ending

inventory valuation at cost as well as resulting gross margins. The methodologies utilized by us in our application

of the RIM are consistent for all periods presented. Such methodologies include the development of the

cost-to-retail ratios, the groupings of homogenous classes of merchandise, the development of shrinkage and

obsolescence reserves, the accounting for price changes and the computations inherent in the LIFO adjustment

(where applicable). Management believes that the RIM provides an inventory valuation that reasonably

approximates cost and results in carrying inventory at the lower of cost or market.

Approximately 50% of consolidated merchandise inventories are valued using LIFO. To estimate the effects

of inflation on inventories, we utilize external price indices determined by an outside source, the Bureau of Labor

Statistics. If the FIFO method of inventory valuation had been used instead of the LIFO method, merchandise

inventories would have been $26 million higher at January 31, 2009 and $22 million higher at February 2, 2008.

56