Rosetta Stone 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

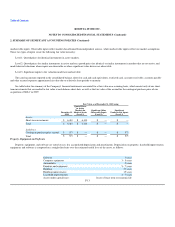

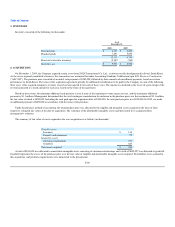

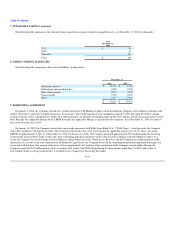

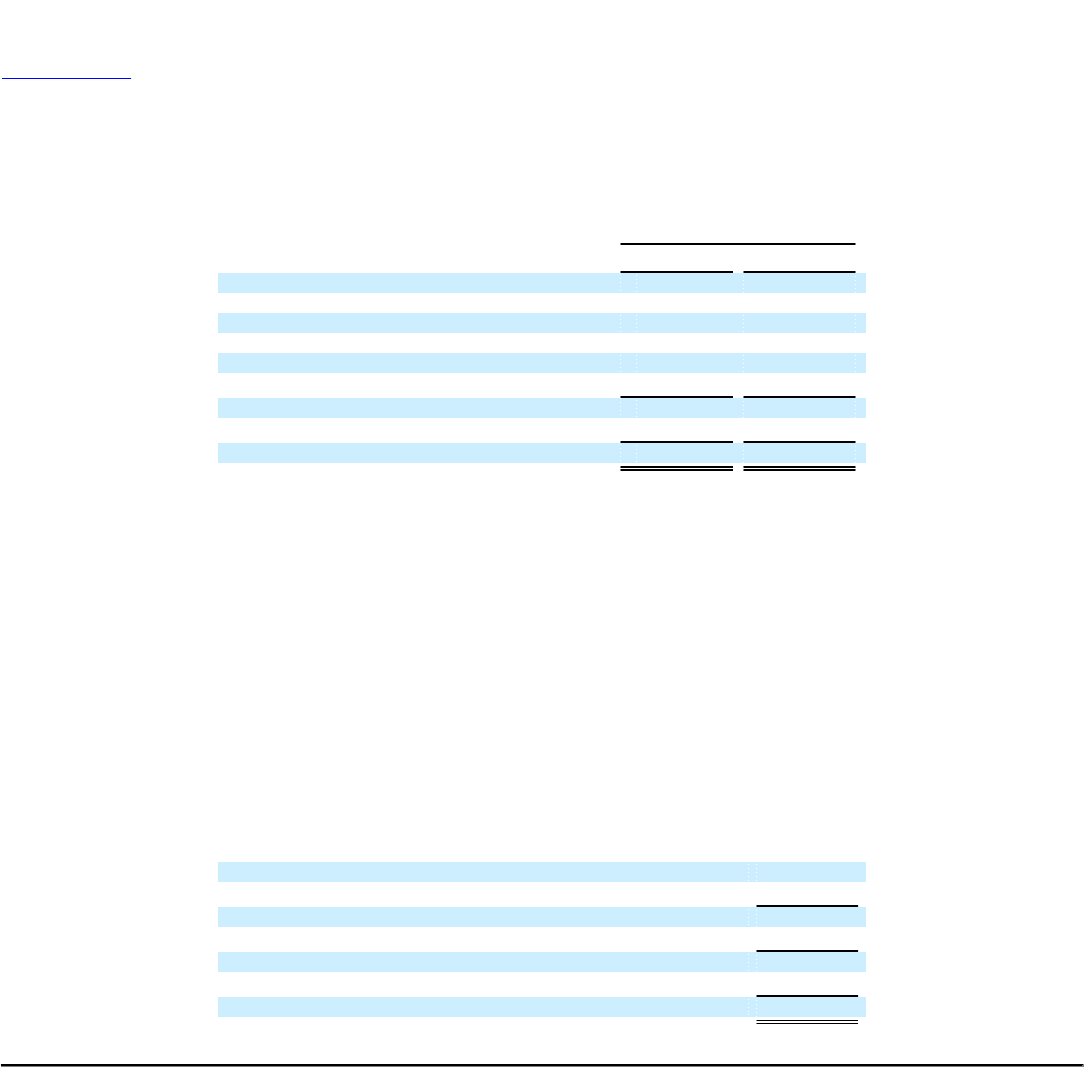

5. PROPERTY AND EQUIPMENT

Property and equipment consisted of the following (in thousands):

As of December 31,

2010 2009

Land $ 390 $ 390

Buildings and improvements 8,110 7,952

Leasehold improvements 1,682 1,453

Computer equipment 12,046 7,617

Software 13,723 11,327

Furniture and equipment 4,158 2,589

40,109 31,328

Less: accumulated depreciation (19,036) (12,954)

Property and equipment, net $ 21,073 $ 18,374

The Company leases certain computer equipment, software and machinery under capital lease agreements, with bargain purchase options at the end of

the lease term. As of December 31, 2010 and 2009, leased computer equipment and software included in property and equipment above was $56,000 and

$56,000, respectively.

The Company recorded depreciation expense for the years ended December 31, 2010, 2009 and 2008 in the amount of $6.6 million, $5.4 million and

$4.0 million, respectively.

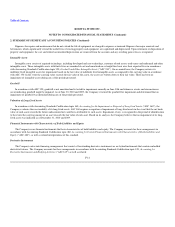

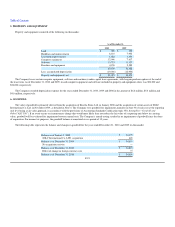

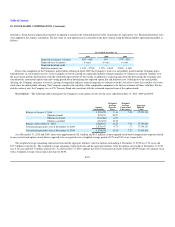

6. GOODWILL

The value of goodwill is primarily derived from the acquisition of Rosetta Stone, Ltd. in January 2006 and the acquisition of certain assets of SGLC

International Co. Ltd. in November 2009, as detailed in Note 4. The Company tests goodwill for impairment annually on June 30 of each year at the reporting

unit level using a fair value approach, in accordance with the provisions of Accounting Standards Codification topic 350, Intangibles—Goodwill and

Other("ASC 350"). If an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying

value, goodwill will be evaluated for impairment between annual tests. The Company's annual testing resulted in no impairments of goodwill since the dates

of acquisition. For income tax purposes, the goodwill balance is amortized over a period of 15 years.

The following table represents the balance and changes in goodwill for the years ended December 31, 2010 and 2009 (in thousands):

Balance as of January 1, 2009 $ 34,199

SGLC International Co. LTD. acquisition 620

Balance as of December 31, 2009 $ 34,819

No acquisition activity —

Balance as of December 31, 2010 $ 34,819

Effect of change in foreign currency rate 37

Balance as of December 31, 2010 $ 34,856

F-21