Rosetta Stone 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

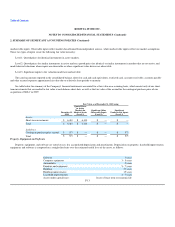

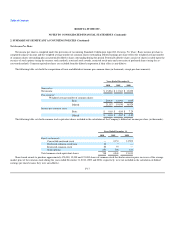

Net Income Per Share

Net income per share is computed under the provisions of Accounting Standards Codification topic 260, Earnings Per Share. Basic income per share is

computed using net income and the weighted average number of common shares outstanding. Diluted earnings per share reflect the weighted average number

of common shares outstanding plus any potentially dilutive shares outstanding during the period. Potentially dilutive shares consist of shares issuable upon the

exercise of stock options (using the treasury stock method), restricted stock awards, restricted stock units and conversion of preferred shares (using the as-

converted method). Common equivalent shares are excluded from the diluted computation if their effect is anti-dilutive.

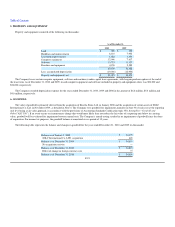

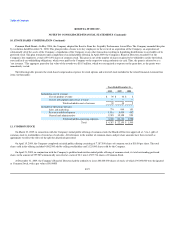

The following table sets forth the computation of basic and diluted net income per common share (in thousands, except per share amounts):

Years Ended December 31,

2010 2009 2008

Numerator:

Net income $ 13,284 $ 13,363 $ 13,892

Denominator:

Weighted average number of common shares:

Basic 20,439 14,990 1,905

Diluted 21,187 19,930 16,924

Income per common share:

Basic $ 0.65 $ 0.89 $ 7.29

Diluted $ 0.63 $ 0.67 $ 0.82

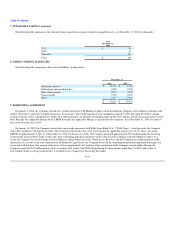

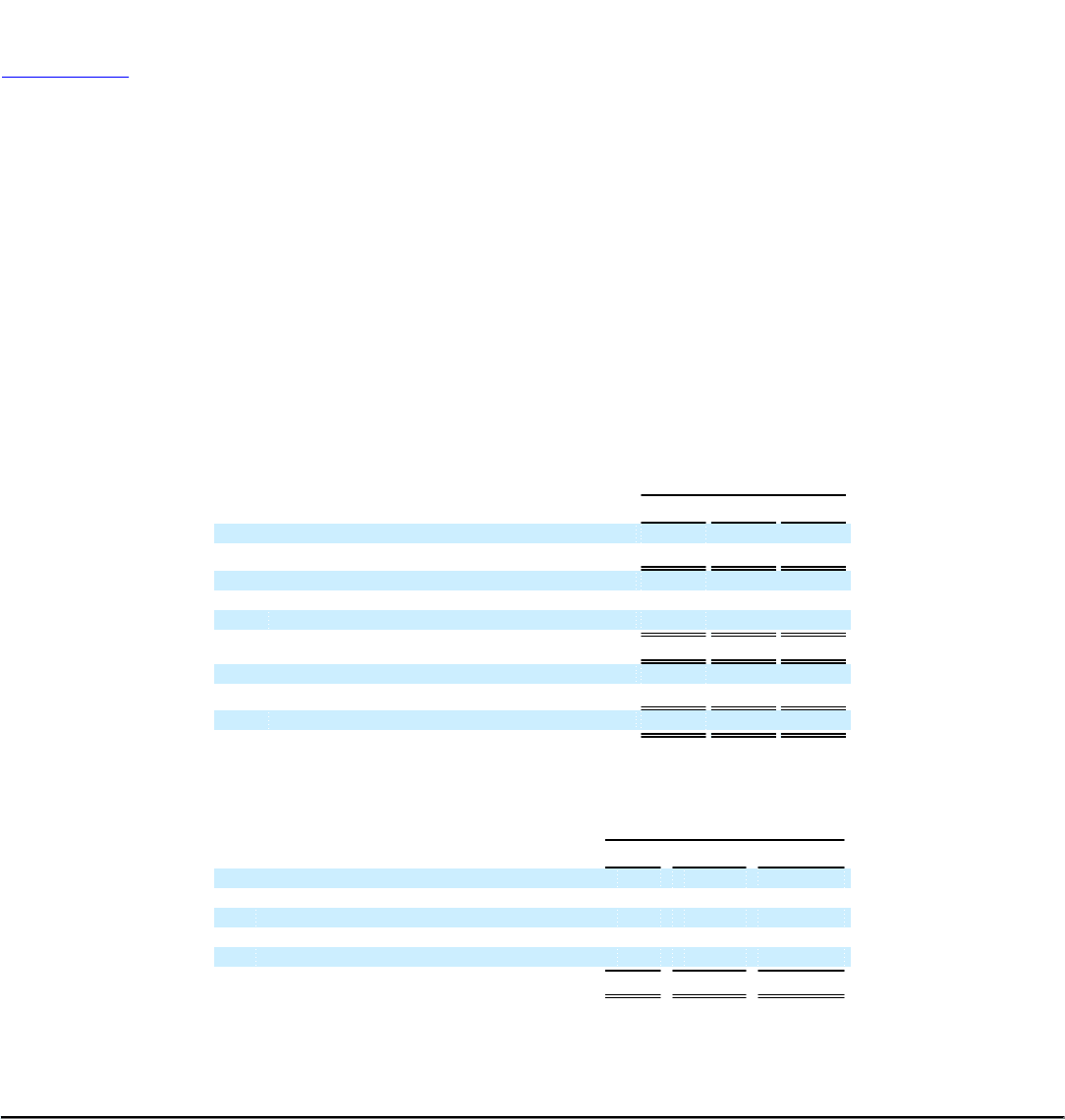

The following table sets forth common stock equivalent shares included in the calculation of the Company's diluted net income per share (in thousands):

Years Ended December 31,

2010 2009 2008

Equity instruments:

Convertible preferred stock — 4,134 14,508

Restricted common stock units 11 7 —

Restricted common stock 86 93 —

Stock options 651 706 511

Total common stock equivalent shares 748 4,940 15,019

Share-based awards to purchase approximately 470,000, 15,000 and 135,000 shares of common stock that had an exercise price in excess of the average

market price of the common stock during the years ended December 31, 2010, 2009 and 2008, respectively, were not included in the calculation of diluted

earnings per share because they were anti-dilutive.

F-17