Rosetta Stone 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. COMMON STOCK (Continued)

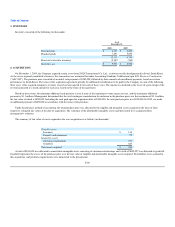

per share, and 10,000,000 were designated as Preferred Stock, with a par value of $0.001 per share. At December 31, 2010 and 2009, the Company had shares

of Common Stock issued and outstanding of 20,975,379 and 20,440,181, respectively.

12. CONVERTIBLE PREFERRED STOCK

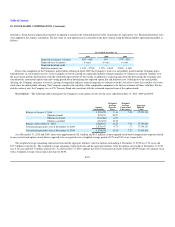

On April 21, 2009, in conjunction with the Company's qualified underwritten initial public offering of common stock, its total outstanding preferred

shares in the amount of 557,989 automatically converted at a ratio of 26:1 into 14,507,714 shares of Common Stock and the then-existing classes of preferred

stock ceased to exist. At December 31, 2010 and 2009, the Company had no preferred shares outstanding and the authorized preferred stock was undesignated

blank check preferred.

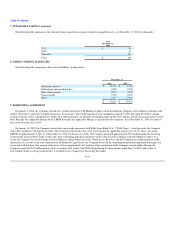

13. EMPLOYEE BENEFIT PLAN

The Company maintains a defined contribution 401(k) Plan (the "Plan"). The Company matches employee contributions to the Plan up to 4% of their

compensation that vest immediately. The Company recorded expenses for the Plan totaling $1.4 million and $1.1 million for the years ended December 31,

2010 and 2009, respectively.

14. COMMITMENTS AND CONTINGENCIES

Operating Leases

The Company leases many kiosks, copiers, parking spaces, buildings, a warehouse and office space under operating lease and site license arrangements,

some of which contain renewal options. The rental payments under some kiosk site licenses are based on a minimum rental plus a percentage of the kiosk's

sales in excess of stipulated amounts. Kiosk site licenses range from a period of one month to five years. Building, warehouse and office space leases range

from three months to 85 months. Certain leases also include lease renewal options.

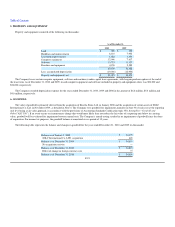

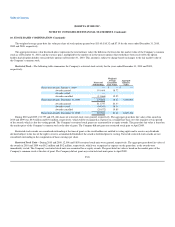

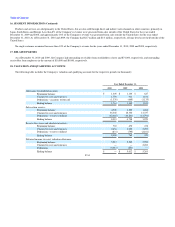

The following table summarizes future minimum operating lease payments as of December 31, 2010 and the years thereafter (in thousands):

As of

December 31,

2010

Periods Ending December 31,

2011 $ 6,611

2012 2,992

2013 2,226

2014 356

2015 207

2016 and thereafter —

$ 12,392

Total expenses under operating leases were $13.0 million and $11.6 million during the years ended December 31, 2010 and 2009, respectively.

F-28