Rosetta Stone 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. COMMITMENTS AND CONTINGENCIES (Continued)

other persons similarly situated who are or were employed as salaried managers by the Company in its retail locations in California are due unpaid wages and

other relief for the Company's violations of state wage and hour laws. Plaintiffs moved to amend their complaint to include a nationwide class on January 21,

2011. We intend to vigorously defend this matter. However, we cannot predict the timing and the ultimate outcome of this matter. Even if the plaintiffs are

unsuccessful in their claims against us, we will incur legal fees and other costs in the defense of these claims.

From time to time, the Company has been subject to various claims and legal actions in the ordinary course of its business. The Company is not currently

involved in any legal proceeding the ultimate outcome of which, in its judgment based on information currently available, would have a material adverse

impact on its business, financial condition or results of operations.

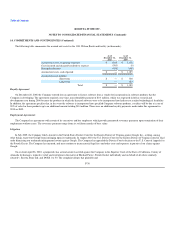

15. INCOME TAXES

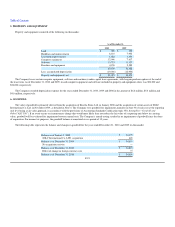

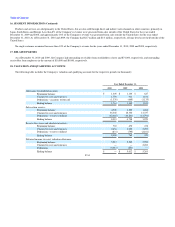

The following table summarizes the significant components of the Company's deferred tax assets and liabilities as of December 31, 2010 and 2009 (in

thousands):

As of

December 31,

2010 2009

Deferred tax assets:

Inventory $ 1,015 $ 290

Amortization and depreciation 1,995 3,521

Net operating loss carryforwards 1,105 4,359

Deferred revenue 2,026 663

Accrued liabilities 8,714 6,456

Stock-based compensation 2,926 2,266

Bad debt reserve 698 425

Foreign currency translation 59 —

18,538 17,980

Valuation allowance — (5,012)

18,538 12,968

Deferred tax liabilities:

Prepaid expenses 876 1,328

Foreign currency translation loss — 50

Other 5 5

881 1,383

Net deferred tax assets $ 17,657 $ 11,585

Net deferred tax assets as of December 31 are classified as follows:

Current $ 11,159 $ 6,020

Non-current 6,498 5,565

Total $ 17,657 $ 11,585

F-31