Rosetta Stone 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

been met. For the years ended December 31, 2010 and 2009, installment sales represented 11%, and 8% of revenue, respectively. Packaged software is

provided to customers who purchase directly from us with a six-month right of return. We also allow our retailers to return unsold products, subject to some

limitations. In accordance with Accounting Standards Codification subtopic 985-605-15, Software: Revenue Recognition: Products ("ASC 985-605-15"),

product revenue is reduced for estimated returns, which are based on historical return rates.

Revenue for software license agreements sold via online software subscriptions as hosting agreements are recognized in accordance with Accounting

Standards Codification subtopic 985-605-05, Software: Revenue Recognition: Background ("ASC 985-605-05"). Revenue for online software subscriptions is

recognized ratably over the term of the subscription period, assuming all revenue recognition criteria have been met, which typically ranges between three and

12 months. Some online licensing arrangements include a specified number of licenses that can be activated over a period of time, which typically ranges

between 12 and 24 months. Revenue for these arrangements is recognized on a per license basis ratably over the term of the individual license subscription

period, assuming all revenue recognition criteria have been met, which typically ranges between three and 12 months. Revenue for set-up fees related to

online licensing arrangements is recognized ratably over the term of the online licensing arrangement, assuming all revenue recognition criteria have been

met. Accounts receivable and deferred revenue are recorded at the time a customer enters into a binding subscription agreement and the subscription services

are made available to the customer. In connection with packaged software product sales and online software subscriptions, technical support is provided to

customers, including customers of resellers, at no additional charge. As the fee for technical support is included in the initial licensing fee, the technical

support and services are generally provided within one year, the estimated cost of providing such support is deemed insignificant and no unspecified

upgrades/enhancements are offered, technical support revenues are recognized together with the software product and license revenue. Costs associated with

the technical support are accrued at the time of sale.

Revenue for online service subscriptions for dedicated conversational coaching are recognized ratably over the term of the subscription period, assuming

all revenue recognition criteria have been met, which typically ranges between three and 15 months. Rosetta Stone V4 TOTALe bundles, which include

dedicated conversational coaching online services and packaged software, allow customers to begin their online services at any point during a registration

window, which typically ranges between six and 12 months from the date of purchase from the Company or an authorized reseller. Dedicated conversational

coaching online service subscriptions that are not activated during this registration window are forfeited and revenue is recognized upon expiry. Accounts

receivable and deferred revenue are recorded at the time a customer purchases the online services.

In accordance with ASC 985-605-50, cash sales incentives to resellers are accounted for as a reduction of revenue, unless a specific identified benefit is

identified and the fair value is reasonably determinable.

We have been engaged to develop language learning software for certain endangered languages under fixed-fee arrangements. These arrangements also

include contractual periods of post-contract support ("PCS") and online hosting services ranging from one to ten years. Revenue for multi-element contracts

are recognized ratably once the PCS and online hosting periods begin, over the longer of the PCS or online hosting period. When the current estimates of total

contract revenue and contract cost indicate a loss for a fixed fee arrangement, a provision for the entire loss on the contract is recorded.

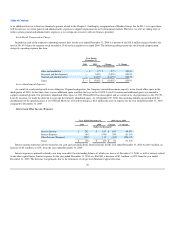

Revenue Recognition for Arrangements with Multiple Deliverables

As of January 1, 2010, we began to recognize revenue prospectively for new arrangements with multiple deliverables in accordance with ASU

No. 2009-13, "Revenue Recognition (Topic 605)—Multiple

46