Rosetta Stone 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

15. INCOME TAXES (Continued)

During the quarter ended December 31, 2010, the Company determined that the relative weight of positive and negative evidence supports that it is more

likely than not that the deferred tax assets relating to foreign operations will be realized and accordingly the Company released its valuation allowance. The

Company had evaluated the valuation allowance on its foreign deferred tax assets quarterly prior to making the determination to release the valuation

allowance during the quarter ended December 31, 2010. As of December 31, 2010, the Company had $3.3 million of net operating loss ("NOL")

carryforwards for United Kingdom income tax purposes that do not expire, with a tax value of $0.9 million. The Company also had $0.5 million of NOL

carryforwards for Japanese income tax purposes which expire in 2015, with a tax value of $0.2 million.

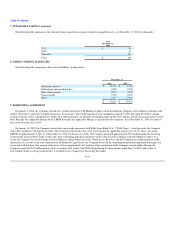

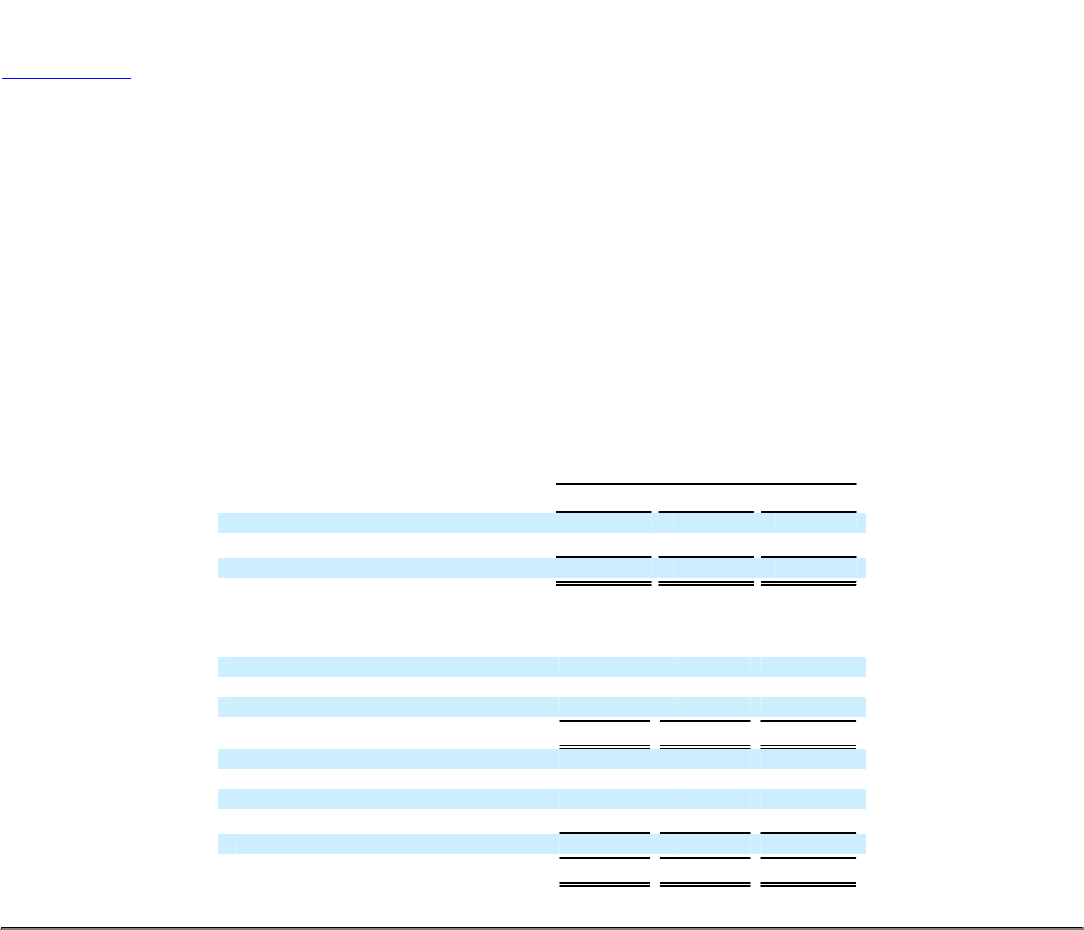

The components of income (loss) before income taxes are as follows (in thousands):

Year Ended December 31,

2010 2009 2008

United States $ 1,683 $ 19,030 $ 36,109

Foreign 11,190 1,417 (8,782)

Income before income taxes $ 12,873 $ 20,447 $ 27,327

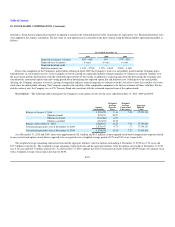

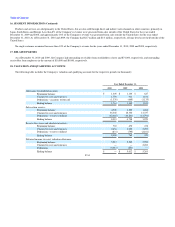

The provision for taxes on income consists of the following (in thousands):

Federal $ 2,739 $ 7,555 $ 12,842

State 1,066 1,864 2,788

Foreign 1,738 140 34

Total current $ 5,543 $ 9,559 $ 15,664

Deferred:

Federal $ (3,099) $ (1,917) $ (1,946)

State (456) (430) (283)

Foreign (2,399) (128) —

Total deferred (5,954) (2,475) (2,229)

Provision for income taxes $ (411) $ 7,084 $ 13,435

F-32