Rosetta Stone 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ROSETTA STONE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. NATURE OF OPERATIONS

Rosetta Stone Inc. and its subsidiaries ("Rosetta Stone," the "Company" or the "Successor") develops, markets and supports a suite of language learning

solutions consisting of software products, online services and audio practice tools under the Rosetta Stone brand name. The Company's software products are

sold on a direct basis and through select retailers. The Company provides its software applications to customers through the sale of packaged software and

online subscriptions. Rosetta Stone Inc. was incorporated on December 23, 2005 in the state of Delaware and acquired Rosetta Stone Holdings Inc., a

Delaware corporation, on January 4, 2006. Rosetta Stone Holdings Inc. acquired Rosetta Stone Ltd. (formerly Fairfield & Sons, Ltd.) and Rosetta Stone (UK)

Limited (formerly Fairfield & Sons UK Limited), on January 4, 2006. Rosetta Stone Inc. has seven wholly owned operating subsidiaries—Rosetta Stone

Holdings Inc., a Delaware corporation, Rosetta Stone Ltd., a Virginia corporation, Rosetta Stone International Inc., a Delaware corporation, Rosetta Stone

Brazil Holding LLC, a Delaware Corporation, Rosetta Stone (UK) Limited, a corporation incorporated under the laws of England and Wales, Rosetta Stone

Japan Inc., a company incorporated under the laws of Japan, and Rosetta Stone GmbH, a company incorporated under the laws of Germany.

On November 1, 2009, the Company acquired certain assets from SGLC International Co. Ltd., headquartered in Seoul, South Korea.

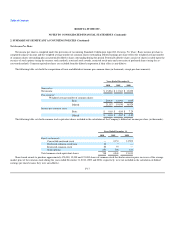

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Initial Public Offering

In April 2009, the Company completed an initial public offering consisting of 7,187,500 shares of common stock at $18.00 per share. The total shares

sold in the offering included 4,062,500 sold by selling stockholders and 3,125,000 shares sold by the Company.

After deducting the payment of underwriters' discounts and commissions and offering expenses, the net proceeds to the Company from the sale of shares

in the offering were $49.0 million. The net proceeds from the offering were used to repay a $9.9 million balance on the revolving credit facility and

$7.9 million to satisfy the federal, state and local withholding tax obligations associated with the net issuance of stock grants made to key employees.

Principles of Consolidation

The consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America and

include the accounts of the Company and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires that

management make certain estimates and assumptions. Significant estimates and assumptions have been made regarding the allowance for doubtful accounts,

estimated sales returns, stock-based compensation, fair value of assets and liabilities acquired, lease abandonment accrual, fair value of intangibles and

goodwill, fair value of stock issued, inventory reserve, disclosure of contingent assets and liabilities and disclosure of contingent litigation. Actual results may

differ from these estimates.

F-8