Rosetta Stone 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

to an additional reserve to limit our financial exposure related to the Chapter 11 bankruptcy reorganization of Borders Group, Inc. In 2011, we expect there

will be increases to certain general and administrative expenses to support expansion into new international markets. However, we also are taking steps to

reduce certain general and administrative expenses as we realign our resources with our business priorities.

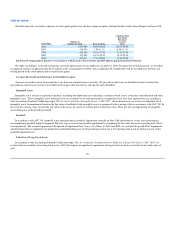

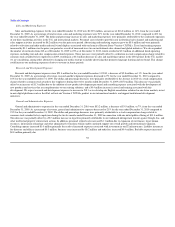

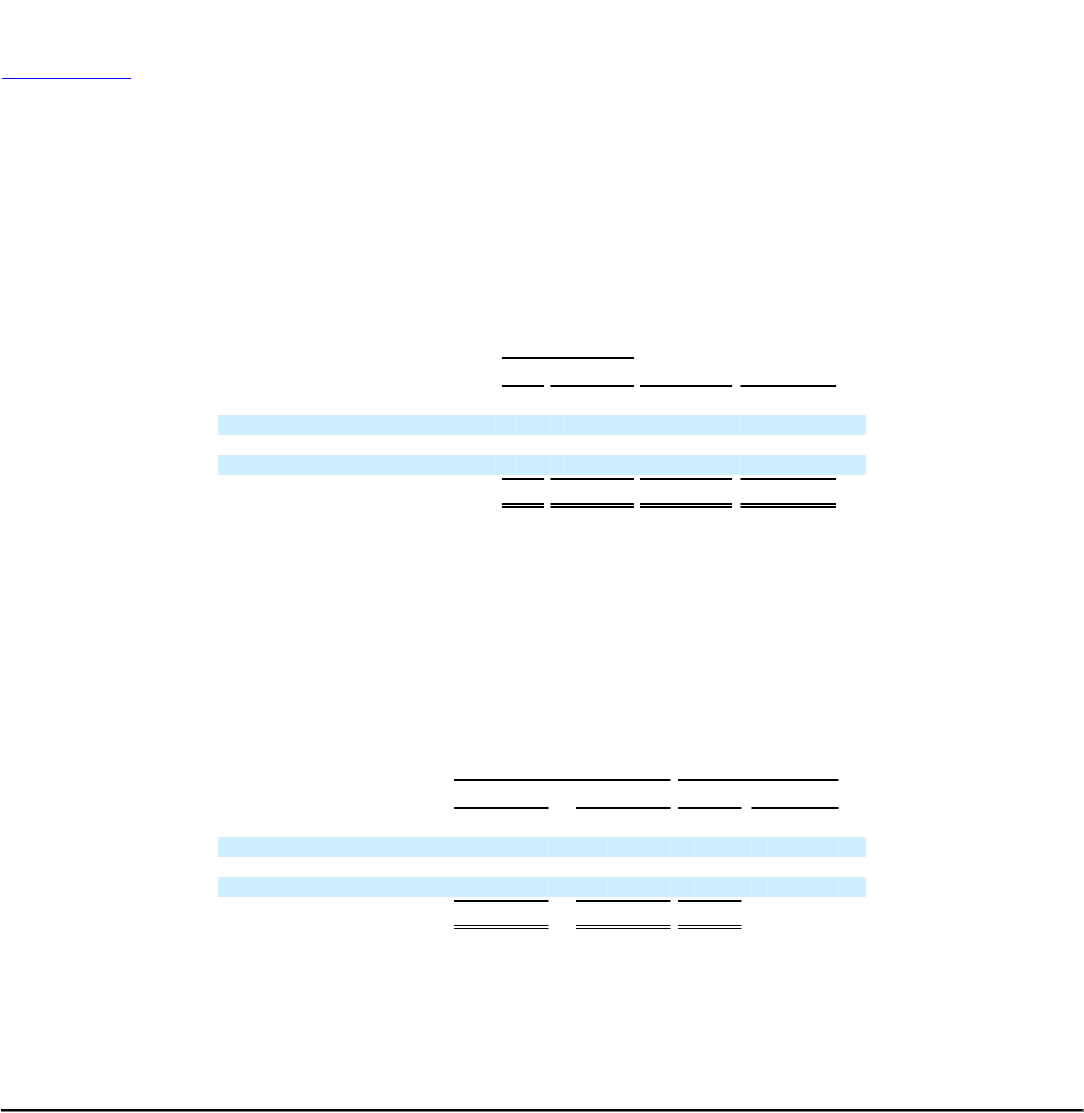

Stock-Based Compensation Charge

Included in each of the respective operating expense lines for the year ended December 31, 2009 is a portion of the $18.8 million charge related to the

total of 591,491 shares of common stock awarded to 10 of our key employees in April 2009. The following table presents the stock-based compensation

charge by operating expense line item:

Year Ended

December 31,

2010 2009 Change % Change

(dollars in thousands)

Sales and marketing — $ 377 $ (377) (100)%

Research and development — 5,033 (5,033) (100)%

General and administrative — 13,393 (13,393) (100)%

Total $ — $ 18,803 $ (18,803) (100)%

Lease Abandonment Expenses

As a result of accelerated growth in our Arlington, Virginia headquarters, the Company exceeded maximum capacity in our leased office space in the

third quarter of 2010. At that time, there was no additional space available for lease in the 1919 N. Lynn St. location and additional space was needed to

support continued growth. Our previously abandoned office space at 1101 Wilson Blvd was unoccupied, and as a result of its close proximity to the 1919 N.

Lynn St. location, we made the decision to reoccupy the formerly abandoned space. As of September 30, 2010, the remaining liability associated with the

abandonment of the operating lease at 1101 Wilson Blvd was reversed resulting in a $0.6 million decrease in expense for the year ended December 31, 2010

compared to December 31, 2009.

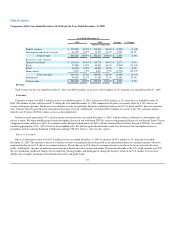

Interest and Other Income (Expense)

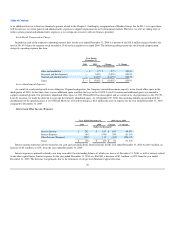

Year Ended December 31, 2010 versus 2009

2010 2009 Change % Change

(dollars in thousands)

Interest Income $ 262 $ 159 $ 103 64.8%

Interest Expense (66) (356) 290 (81.5)%

Other Income (Expense) (220) 112 (332) (296.4)%

Total $ (24) $ (85) $ 61 (71.8)%

Interest income represents interest earned on our cash and cash equivalents. Interest income for the year ended December 31, 2010 was $0.3 million, an

increase of $0.1 million, or 65%, from the year ended December 31, 2009.

Interest expense is primarily related to our long-term debt, the outstanding balance of which was zero as of December 31, 2010, as well as interest related

to our other capital leases. Interest expense for the year ended December 31, 2010 was $66,000, a decrease of $0.3 million, or 82% from the year ended

December 31, 2009. The decrease was primarily due to the retirement of our previous Madison Capital term loan.

56