Rosetta Stone 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

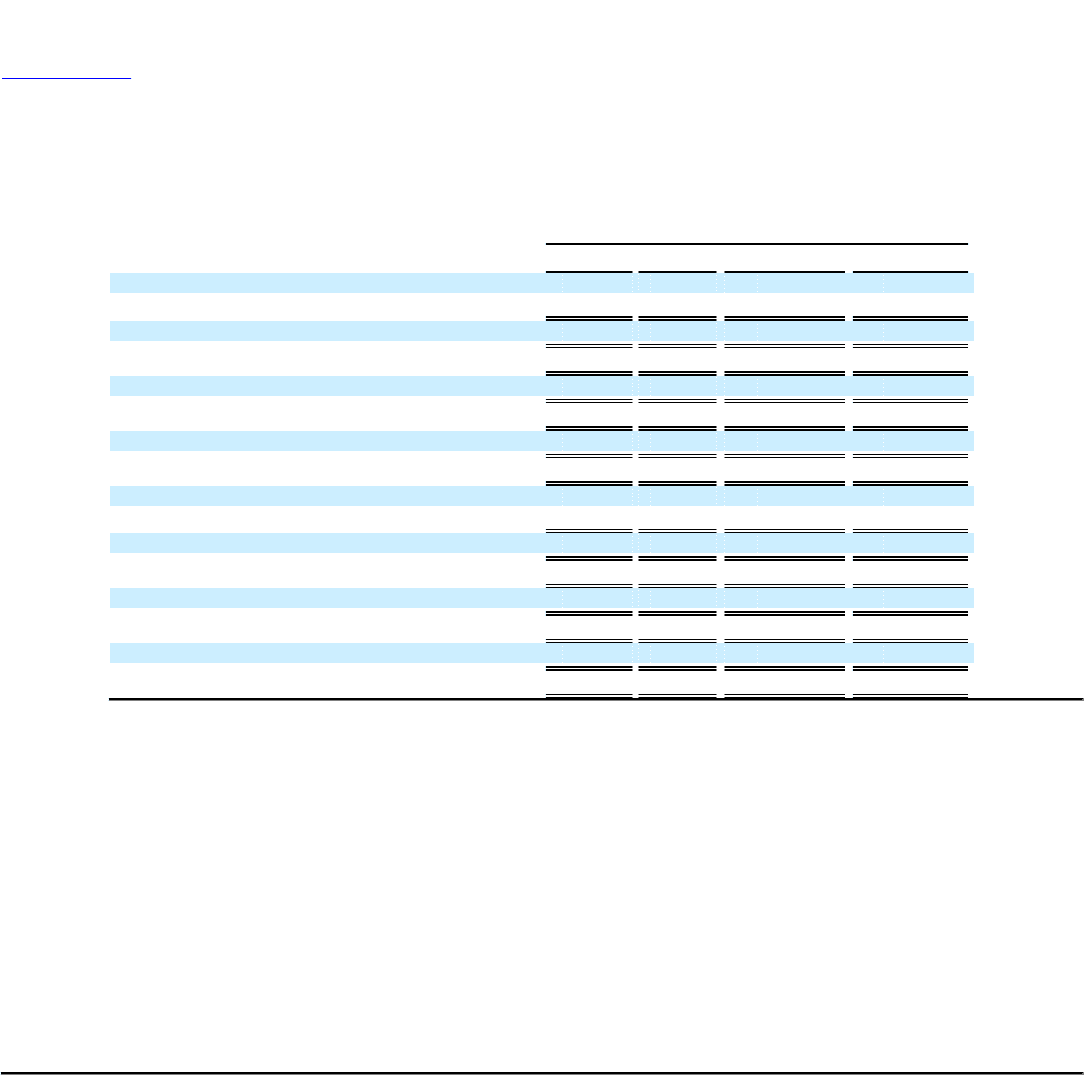

19. SUPPLEMENTAL QUARTERLY FINANCIAL INFORMATION (Unaudited)

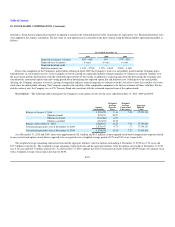

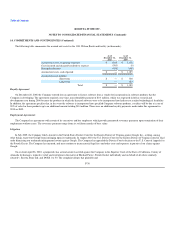

Summarized quarterly supplemental consolidated financial information for 2010 and 2009 are as follows (in thousands, except per share amounts):

Quarter Ended

March 31, June 30, September 30, December 31,

2010

Revenue $ 63,014 $ 60,648 $ 60,926 $ 74,280

Gross profit $ 54,372 $ 53,046 $ 50,497 $ 61,954

Net income (loss) $ 5,005 $ 3,699 $ (385) $ 4,965

Basic income per share $ 0.25 $ 0.18 $ (0.02) $ 0.24

Shares used in basic per share computation 20,258 20,346 20,490 20,652

Diluted income per share $ 0.24 $ 0.17 $ (0.02) $ 0.23

Shares used in diluted per share computation 21,060 21,220 20,490 21,265

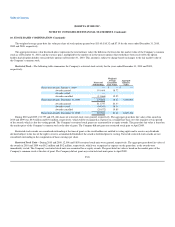

2009

Revenue $ 50,284 $ 56,460 $ 67,216 $ 78,311

Gross profit $ 43,857 $ 48,758 $ 58,208 $ 68,021

Net income (loss)(a) $ 3,195 $ (7,292) $ 5,303 $ 12,157

Basic income per share(a) $ 1.65 $ (0.42) $ 0.26 $ 0.60

Shares used in basic per share computation 1,939 17,370 20,177 20,216

Diluted income per share(a) $ 0.19 $ (0.42) $ 0.25 $ 0.58

Shares used in diluted per share computation 17,095 17,370 20,988 20,968

The second quarter of 2009 contained an IPO-related $18.8 million expense, consisting of $18.5 million in stock-based compensation

expense and $0.3 million in payoll tax expense, related to common stock grants awarded to key employees equal to a total of 591,491

shares.

(a)

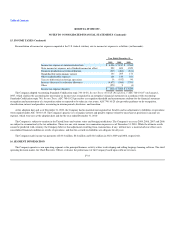

20. SUBSEQUENT EVENTS

On January 4, 2011, the Company's board of directors approved the Rosetta Stone Inc. Long Term Incentive Program ("LTIP"), a new long-term

incentive program. The LTIP, which will be administered under the Rosetta Stone Inc. 2009 Omnibus Incentive Plan (the "Plan") and the shares awarded

under the LTIP will be taken from the shares reserved under the Plan. The purpose of the LTIP is to: advance the best interests of the Company; motivate

senior management to achieve key financial and strategic business objectives of the Company; offer eligible executives a competitive total compensation

package; reward executives in the success of the Company; provide ownership in the Company; and retain key talent. Executives designated by the board of

directors will be eligible to receive shares of restricted common stock for each milestone level of total market capitalization achieved, as specified in

individual award agreements. For each milestone achieved in market capitalization from the market capitalization as of October 1, 2010, the compensation

committee of the board of directors will allocate a share incentive pool amongst the participating executives as specified in individual award agreements. For

the first $100 million increase in market capitalization, participating executives will be eligible to receive a portion of 75,000 shares of the share incentive

pool restricted common stock. Each

F-35